Key Takeaways

- Rent increase notices: Landlords must give tenants a 60-day written notice of a rent increase, or a 30-day notice for periodic tenancies of less than a month.

- Late rent payments: The grace period for rent payments in Nevada is three days. If a tenant still hasn’t paid rent after the grace period, landlords can charge a late fee of up to 5% of the rent.

- Required disclosures: Landlords must disclose the consequences of public nuisances, the process for reporting public nuisances or code violations, tenants’ right to display the U.S. flag, and if the property is under foreclosure.

- Security deposits: Landlords can charge up to the equivalent of three months’ rent for the security deposit, and they must return the security deposit within 30 days of the lease ending.

- Transparent pricing: Nevada landlords are now required to advertise the total cost of their rental in a listing, including the base rent and nonoptional fees.

Table of Contents

- Overview of Rental Laws in Nevada

- What’s New in 2026: Recent Legal Updates in Nevada

- Compliance Tips for Landlords

- Ensure Compliance with Apartments.com

- FAQs

Overview of Rental Laws in Nevada

Rent control and rent stabilization

Nevada law doesn’t limit how much landlords can increase rent, but landlords are required to give tenants a written 60-day notice of the increase. For periodic tenancies of less than a month, landlords must serve a written 30-day notice (NRS § 118A.300).

Lease agreement rules

In addition to standard lease terms, here are some clauses and disclosures Nevada landlords are required to include in their lease agreements:

- The consequences of public nuisances (NRS § 202.470)

- The process for reporting nuisances or violations of building, safety, or health regulations (NRS § 118A.200(3)(m))

- Tenants’ right to display the U.S. flag (NRS § 118A.325)

- If the property is pending foreclosure (NRS § 118A.275)

- NEW: If a utility company is unable to contract directly with the tenant (A.B. 121)

- NEW: If the unit is subject to a master-meter water system (A.B. 121)

Security deposits

The maximum security deposit a landlord can charge in Nevada is three months’ rent, and landlords must provide an itemized list of deductions and any remaining portion of the deposit within 30 days of the lease ending (NRS § 118A.242).

Upon request, landlords must provide tenants with a written receipt for the security deposit, fees, rent, and any other payments. Tenants have the right to withhold rent until their landlord presents the requested receipt (NRS § 118A.250).

Late fees

In Nevada, landlords must give tenants a three-day grace period for rent payments. If a tenant fails to pay rent after the grace period ends, landlords can charge a late fee of up to 5% of the rent (NRS § 118A.210).

Eviction procedures

For nonpayment of rent, landlords must give tenants a seven-day notice to pay or quit (NRS § 40.253). For other lease violations, landlords must give tenants a five-day notice to cure or quit (NRS § 40.2516).

In cases like selling illegal drugs, severe property damage, or subletting in violation of the lease agreement, landlords can send an unconditional three-day notice to quit (NRS § 40.2514). This requires tenants to move out within three days, without the opportunity to fix the problem.

Maintenance and habitability requirements

Nevada law outlines the following for habitability:

- Waterproofed and weather-protected roofing and exterior walls

- Hot and cold running water

- Heating, plumbing, electrical wiring, and lighting in working order

- Adequate garbage receptacles

- Property grounds free from trash, waste, and pests

While appliances like air conditioning or elevators are not required by law, property managers must keep them in good condition if they’re offered.

What’s New in 2026: Recent Legal Updates in Nevada

Price transparency

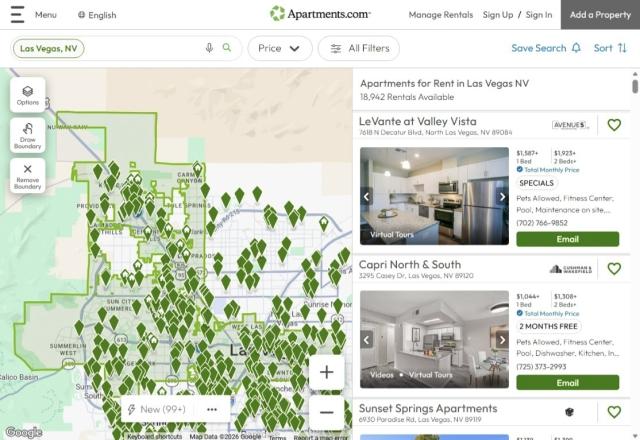

A.B. 121 amended NRS § 118A to require landlords to advertise the total cost of their rental, including base rent and all nonoptional fees. This went into effect on Oct. 1, 2025.

The only exception is utility bills, which can be billed separately if the utility company cannot bill the tenant directly or if the water is master-metered. The lease agreement must disclose the reason for utilities being billed separately. Landlords cannot charge more than the cost of the utility bill.

Rent payment options

A.B. 121 also requires landlords to provide at least one payment method that does not include extra fees and does not require a tenant’s bank account information.

Additionally, any fees for online payments must be clearly outlined in the lease agreement and cannot be more than what the online payment system charges.

Application fees

A.B. 121 requires landlords to refund an application fee if the landlord rents the property to another tenant or does not run the background check or process the application. The act also prohibits landlords from collecting application fees for minors who are part of the household of the prospective tenant.

Compliance Tips for Landlords

Update lease templates

Make sure your lease agreements reflect all required disclosures, including the right to display the U.S. flag, the process for reporting public nuisances or code violations, alternative payment options, and the reason for utilities being billed separately (if applicable).

Adjust fee structures

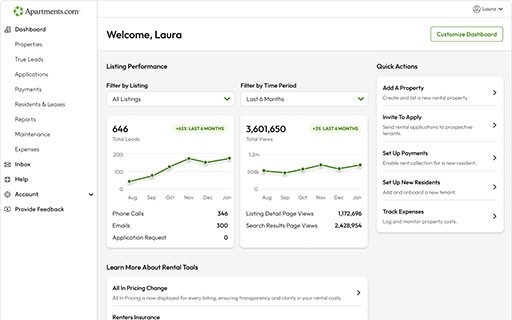

Edit your rental listing to include all required monthly fees. On Apartments.com, Nevada listings that include nonoptional fees will have a “Total Monthly Price” badge, signaling to renters that the price they see is what they’ll pay.

Document procedures for legal compliance

Keep detailed records of rent increases, notices to quit, repairs, and communications with tenants to demonstrate compliance with Nevada Revised Statutes in case of disputes. When you communicate with tenants on Rental Manager Messages, you can archive old conversations to make sure you never lose important information.

Ensure Compliance with Apartments.com

Managing legal responsibilities as a landlord can be challenging, especially with so many other priorities on your plate. From screening tenants to collecting rent, staying compliant and organized is no small task. However, it’s much easier to stay on top of everything when you have the right tools.

Apartments.com can help. Our Rental Tools suite simplifies the rental process while ensuring compliance at every step. From creating property listings and drafting state-compliant lease agreements to handling maintenance requests and tracking your expenses, streamline your workflow while ensuring every action is compliant with federal and state laws.

This article is for informational purposes only and does not constitute legal, financial, or professional advice. For guidance specific to your situation, you should consult a qualified attorney or other relevant professional.

FAQs

Is rent control in effect in Nevada?

No, rent control is not in effect in Nevada. However, property managers are required to give tenants a 60-day written notice ahead of a rent increase. For periodic tenancies less than a month, property managers must serve a 30-day written notice.

What’s the legal process for evicting a tenant in Nevada?

Landlords must give tenants a seven-day notice to pay or quit if a tenant isn’t paying rent and a five-day notice to cure or quit if a tenant is otherwise violating the lease. In cases of extreme violations like illegal activity or subletting against the lease terms, landlords can send a three-day notice to quit that requires tenants to move out without the opportunity to cure the violation.

Does Nevada law require landlords to disclose all fees upfront?

Yes, Nevada law requires property managers to advertise the total price of their rental in a listing. This means that the listed price should include both base rent and all nonoptional monthly fees.

What’s the maximum security deposit allowed in Nevada?

Nevada law limits security deposits to the equivalent of three months’ rent.

When is rent considered late in Nevada?

In Nevada, rent is considered late three days past the due date.