If you own rental property in Louisiana, you may be all too familiar with the unique risks that come with the territory. From hurricanes along the Gulf Coast to heavy rainfall across the state, the threat of flooding is a constant concern. A standard landlord insurance policy won't protect your investment from water damage caused by floods. You need a separate policy to safeguard your property and your business.

Let’s explore why flood insurance is essential, what Louisiana law requires, and how to get the right protection for your rental properties. Understanding these key points helps you protect your assets and maintain a stable rental income, even when the weather takes a turn for the worse.

Key Takeaways

• Standard landlord insurance does not cover flood damage, leaving property owners responsible for all repairs and lost income unless they purchase a separate flood policy.

• Flood insurance is federally required for properties in Special Flood Hazard Areas with a government-backed mortgage—but even properties outside high-risk zones face real flood threats and are eligible for more affordable coverage.

• Educating tenants about renters insurance with flood coverage is crucial, as landlord policies do not protect tenants' personal belongings.

Why Flood Insurance Is a Must-Have in Louisiana

For landlords in the Pelican State, flood insurance isn't just a good idea—it's a critical part of a sound investment strategy. Standard landlord and homeowner policies almost never cover damage from flooding. This means if your rental property is damaged by rising water from a storm surge, overflowing river, or torrential rain, you could be facing the full cost of repairs on your own.

From 1978-2021, Louisiana was the largest recipient of funds from the National Flood Insurance Program (NFIP), a clear indicator of the state's high flood risk. The aid is often provided as a loan that must be repaid and is only available if a federal disaster is declared. Flood insurance, on the other hand, provides reliable coverage regardless of a disaster declaration.

Without flood insurance, a single flood event could wipe out your rental income and potentially lead to the loss of your property. By securing a flood insurance policy, you protect your investment from one of the most common and costly natural disasters in the state.

Is Flood Insurance Required for Your Rental?

While not all properties in Louisiana are legally required to have flood insurance, many are. The rules depend on your property's location and mortgage status.

Properties in high-risk flood zones

If your rental property is located in a high-risk flood area, also known as a Special Flood Hazard Area (SFHA), and you have a mortgage from a federally regulated or insured lender, you are required by federal law to have flood insurance. These zones are designated on Flood Insurance Rate Maps (FIRMs) created by the Federal Emergency Management Agency (FEMA). Check your property's flood risk using FEMA's Flood Map Service Center.

Properties outside high-risk zones

Even if your property is not in an SFHA, flood insurance is still a wise investment. A significant portion of flood claims come from properties in moderate-to-low-risk areas. Flooding can happen anywhere, and the cost of a policy in a lower-risk zone is often much more affordable, making it a cost-effective way to protect your asset.

NFIP vs. Private Flood Insurance: What's the Difference?

When purchasing flood insurance, you have two main options: the National Flood Insurance Program (NFIP) or a private insurance carrier. Understanding the differences between them can help you choose the best fit for your needs.

National Flood Insurance Program (NFIP)

The NFIP is a federal program managed by FEMA that provides the majority of flood insurance policies in the United States. You can purchase an NFIP policy through a licensed insurance agent.

- Advantages: NFIP policies are often more affordable than private flood insurance, especially for properties in high-risk flood zones. Also, policies are widely accessible with clear terms as to what is covered.

- Limitations: NFIP policies generally do not cover basements, additional living expenses if your tenants must relocate, or damage to detached structures like sheds or garages.

- Valuation: Coverage is typically based on Actual Cash Value (ACV), which accounts for depreciation, rather than Replacement Cost Value (RCV).

Private Flood Insurance

Private insurers also offer flood policies, and they have become more common in recent years. These policies are often more flexible and can provide broader protection.

- Advantages: You can shop around for a policy that best fits your needs. Private policies offer additional coverage for loss of rental income, something which NFIP policies do not include. Also, private policies can offer coverage levels well above the NFIP’s dollar cap.

- Limitations: Not all mortgage lenders accept private flood insurance, and the ability to obtain private coverage may be non-existent in certain locations. Before choosing a private policy, confirm that your lender will accept it. There may also be high deductibles.

- Valuation: Many private policies offer Replacement Cost Value (RCV) coverage, which pays to rebuild your property to its previous state without deducting for depreciation. They may also cover additional living expenses (loss of rent) and detached structures.

Practical Steps for Louisiana Landlords

Securing flood insurance involves a few important steps. Here is what you need to do to get your rental property covered.

1. Purchase a policy.

The easiest way to get flood insurance is to contact your current insurance agent. They can help you explore options from both the NFIP and private carriers. They will assess your property's specific needs and provide quotes, allowing you to compare coverage and costs.

2. Be aware of the waiting period.

One of the most critical things to remember is that flood insurance policies do not take effect immediately. NFIP policies typically have a 30-day waiting period from the date of purchase before coverage begins. Some private policies may offer shorter waiting periods, but you should never wait until a storm is approaching to buy a policy. Plan ahead, especially before the start of hurricane season on June 1st.

3. Educate your tenants.

Your landlord flood insurance policy covers the physical structure of your rental property. It does not cover your tenants' personal belongings. It is essential to communicate this clearly in your lease agreement and during the move-in process.

Encourage your tenants to purchase their own renters insurance with flood coverage for their contents. Renters can buy policies that protect their furniture, electronics, and other personal items in the event of a flood. This not only protects your tenants but also helps prevent disputes and potential liability claims against you after a disaster.

Protect Your Louisiana Investment

For Louisiana landlords, flood insurance is an indispensable tool for risk management. It provides a financial safety net against the state’s most frequent natural disaster, ensuring that your investment is protected and your rental business can weather any storm. By understanding the requirements, comparing your options, and planning ahead, you can secure the right coverage to safeguard your property for years to come.

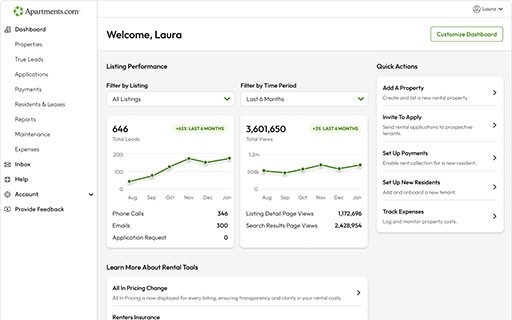

Are you ready to list your Louisiana rental? Check out Apartments.com rental management tools to get the ball rolling!

Frequently Asked Questions

Is flood insurance mandatory for my rental property in Louisiana?

It depends on your property's location and whether you have a federally backed mortgage. Properties in high-risk flood zones (Special Flood Hazard Areas) are typically required to have flood insurance.

How much does flood insurance cost in Louisiana?

The cost varies based on factors like the property's location, flood zone designation, and coverage limits. Properties in high-risk areas typically have higher premiums.

Can I have both private and NFIP flood insurance coverage?

You may be able to supplement your NFIP coverage with private insurance for items not covered under the NFIP, such as loss of income. It’s best to consult a licensed insurance agent for more information.