Florida’s natural beauty comes with a significant risk: flooding. Floods are one of the most common and costly natural disasters in Florida. From hurricane storm surges to afternoon deluges, water damage is a constant threat. While you likely know about standard landlord insurance, it’s crucial to understand standard policies do not cover flood damage. This gap in coverage can leave your investment property—and your financial future—exposed.

According to Florida’s Division of Emergency Management, 80 percent of the state’s 22 million residents live or work along the state’s coastline. If you own a rental property in Florida—or plan to—understanding how flood insurance works and why it’s essential can protect your investment and help you recover faster when storms strike. Let’s explore why flood insurance is a non-negotiable part of your risk management strategy, what it covers, and how to secure the right protection for your rental properties.

Key Takeaways:

• Flood damage is not covered by standard landlord insurance, and with 80% of Florida's population living or working near the coast, flood insurance is a critical layer of protection for rental property owners.

• Even low-risk areas are vulnerable— the Federal Emergency Management Agency (FEMA) reports that 99% of U.S. counties have experienced flooding in the past 20 years. Just a few inches of water can cause tens of thousands of dollars in structural damage and income loss.

• Private flood insurance offers expanded benefits, including higher coverage limits and loss of rental income protection, potentially at a lower premium than National Flood Insurance Program (NFIP) policies.

Understanding FEMA's Official Definition of a Flood

Before we dive into what flood insurance covers, it's important to know FEMA's definition of a flood. FEMA defines a flood as an excess of water on land that is normally dry, impacting either two or more acres of land or two or more properties. This definition is important because not all water damage qualifies as a flood for insurance purposes.

Damage from things like burst pipes or localized plumbing issues generally isn't covered by flood insurance—coverage applies specifically when a large-scale event meets FEMA’s definition. Landlords should be aware of this distinction to avoid surprises during the claims process.

Why Florida Landlords Need Flood Insurance

Florida’s geography makes it uniquely vulnerable to flooding. With its long coastline, low elevation, and frequent heavy rainfall, no part of the state is completely safe from water damage. For landlords, relying on a tenant's renter's insurance or your standard property policy is a mistake that can cost you.

Consider the financial implications of a flood without proper coverage. A few inches of water can lead to tens of thousands of dollars in repairs. You would be responsible for repairing structural damage, replacing systems like HVAC and electrical, and remediating mold. During this time, your property may be uninhabitable, leading to a loss of rental income. Without flood insurance, these costs come directly out of your pocket.

The high cost of unprotected rental investments

Many property owners mistakenly believe they don't need flood insurance because they aren't in a high-risk flood zone. However, FEMA states during the last 20 years, 99% of counties in the U.S. have experienced a flood event.

Florida's weather is unpredictable, and development can alter natural drainage patterns, creating new flood risks where none existed before. Failing to secure flood insurance means you are self-insuring against one of the most common and costly natural disasters in the state.

What Does Flood Insurance Cover?

Flood insurance policies are designed to protect you from losses caused by a flood, but it’s important to understand that these policies typically offer two types of coverage: building coverage and contents coverage.

1. Building coverage

Building coverage is the most critical component. This part of the policy protects the physical structure of your rental property.

Key items covered include:

- The foundation, walls, and staircases

- Electrical and plumbing systems

- HVAC equipment, including furnaces and water heaters

- Permanently installed carpeting and cabinets

- Built-in appliances like refrigerators and dishwashers

This coverage ensures you have the funds to repair or rebuild your rental property after a flood, allowing you to get it back on the market faster.

2. Contents coverage

Contents coverage protects the personal belongings inside a property. While this is primarily the tenant's responsibility (covered by their renter's insurance), you may want it for items you own within the rental unit.

If you furnish your rental property or keep maintenance equipment (like lawnmowers or tools) on-site, you should consider adding contents coverage to your policy. This protects your specific assets, separate from your tenant's belongings.

Choosing the Right Flood Policy

Navigating the flood insurance market can seem complex, but understanding your options is key. Policies can be purchased through the National Flood Insurance Program (NFIP) or obtained from private insurers.

1. The National Flood Insurance Program (NFIP)

The NFIP is a federal program managed by FEMA that provides the majority of flood insurance policies in the country. NFIP policies have standardized coverage limits, which are currently set at $250,000 for residential building coverage and $100,000 for contents.

2. Private flood insurance

Private flood insurance is an increasingly popular alternative. These policies are offered by private companies and can provide more flexibility. Benefits often include:

- Higher coverage limits: Private insurers can offer building coverage that exceeds the NFIP's $250,000 cap, which is ideal for higher-value properties.

- Additional coverage: Some private policies include coverage for loss of rental income, something not available through the NFIP.

- Potentially lower premiums: Depending on your property's risk profile, you may find a more competitive rate in the private market.

It is wise to get quotes from both NFIP-backed providers and private insurers to compare costs, coverage limits, and added benefits like loss of rent protection.

Practical Steps for Protecting Your Investment

Securing flood insurance is the first step. To fully protect your investment, you should also take a proactive approach to flood risk management.

- Assess your true risk: Use FEMA's Flood Map Service Center to understand your property's designated flood zone. Remember, even properties in Zone X (a low-to-moderate risk area) can and do flood.

- Understand policy requirements: For NFIP insurance, take note of the standard 30-day waiting period for the policy to take effect (with limited exceptions). Depending on the insurer, private insurance coverage may begin sooner than 30 days.

- Comply with local regulations: If your property is in a Special Flood Hazard Area (SFHA) and you have a mortgage from a federally regulated lender, you are legally required to have flood insurance.

- Encourage tenants to get renter's insurance: Educate your tenants on the importance of renter’s insurance and consider making it a requirement in your lease agreement. This ensures they can recover faster, which can lead to a more stable tenancy.

Secure Your Florida Rental Property

As a landlord in Florida, you cannot afford to overlook the risk of flooding. A standard insurance policy leaves a gap that only dedicated flood insurance can fill. Protecting your property with a robust policy is essential for safeguarding your asset, maintaining your rental income, and ensuring your long-term success as a real estate investor.

Take the time to evaluate your risk, compare policy options between the NFIP and private markets, and secure the coverage that best fits your needs. Protecting your investment from floodwaters is one of the smartest business decisions you can make.

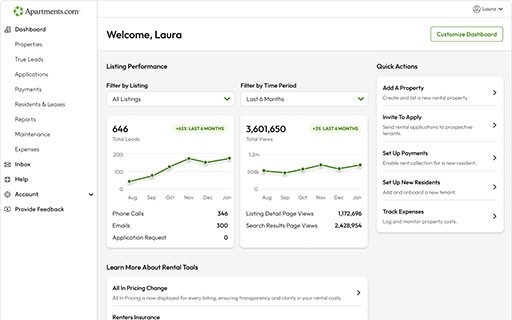

Take Your Listing to the Next Level

With Apartments.com rental tools, you can list your Florida property for free, screen applicants, and more. Upgrade to a premium listing and create an online Matterport 3D tour of your rental using your smartphone to reduce the need for scheduling in-person showings. With Apartments.com and Matterport’s state-of-the-art technology, prospects can freely explore your rental at their convenience 24 hours a day, seven days a week.

Ready to find a great tenant? Get started now!