Big cities have dominated renter demand, but priorities are shifting. Today’s renters are gravitating towards cities that pair steady job markets with affordability and livability. That shift creates an opportunity for landlords to invest in real estate in areas that have steady demand without the barriers of massive metros.

The best cities to invest in real estate in 2026 are:

Methodology

We found the best cities for landlords based on housing prices, renter demand, average rent, and the percentage of properties listed as for rent by owner. All rent and housing data is from Apartments.com as of February 2026.

Saint Louis, MO

| Renters | Homeowners |

|---|---|

|

|

Why renters are moving to Saint Louis

Saint Louis mixes affordability with employment opportunities to create an enticing city for renters. Education, healthcare, financial services, and manufacturing employ many of the residents. Washington University, Saint Louis University, government institutions, hospitals, healthcare organizations, and Fortune 500 and 1000 companies are the top employers in the city.

Though the economy is a major driver for renters moving to the city, where they move depends on personal preferences. Many choose downtown for its proximity to employers, but just as many opt for the suburbs. It’s still easy to get downtown, but it is more budget-friendly and has a quieter atmosphere. Affordability is important for Saint Louis renters as many will choose older, lower-priced rentals over high-end ones.

The city’s ongoing revitalization gives renters another reason to live in Saint Louis. Walkable shopping and dining corridors, museums, stadiums, and parks pepper the city, giving renters plenty to explore. The big-city opportunities combined with affordability continue to encourage renters to bet on Saint Louis.

Takeaways for landlords in Saint Louis

Emphasize your rental’s location and distance to major employment hubs. Renters prioritize convenience so detail commute routes in your property description.

If you’re buying a rental property, take into consideration what is around the property. Renters love entertainment-rich areas and districts. Being near shopping and dining options as well as cultural attractions is a must-have for many.

Baltimore, MD

| Renters | Homeowners |

|---|---|

|

|

Why renters are moving to Baltimore

Baltimore benefits from its location near Washington DC. Renters appreciate the proximity to the larger employment center without paying the high DC rents. However, Baltimore is a powerhouse of its own with expansive healthcare systems, universities, and research institutions. John Hopkins University and the University of Maryland, Baltimore, along with many large businesses in the financial, government, and manufacturing fields, employ a large percentage of the city.

Baltimore’s historic character gives the city a personality renters can’t easily find elsewhere, and it’s more affordable than most East Coast metros. Neighborhoods around the Inner Harbor and downtown see high demand for its charm and proximity to employers. Evolving suburban spots continue to gain popularity among those seeking a balance of space, affordability, and metro access, thanks to the light rail and subway.

Takeaways for landlords in Baltimore

Show off the character of your rental with high-quality photography that highlights architectural details and historic character as these are features that resonate with Baltimore renters. Capture exposed brick, original trim, and distinctive layouts to leverage the unique details of your property.

While renters love historical charm, they don’t want it at the expense of modern comforts. They look for renovated interiors with new appliances, updated bathrooms, and the latest amenities. Make sure to include any modern updates in your property description and provide photos.

Jacksonville, FL

| Renters | Homeowners |

|---|---|

|

|

Why renters are moving to Jacksonville

Jacksonville has emerged as one of the fastest-growing Sun Belt metros, driven by an influx of renters following the diverse economy and low cost of living. Downtown is the heart of the finance, healthcare, logistics, and manufacturing industries while the military presence centers around the coastal waters.

Lifestyle plays an equally important role. Many move to Jacksonville looking for the sun, sand, and surf that Florida is known for, but at an affordable price. The beaches are about 30 minutes from downtown, so it’s easy to enjoy a coastal lifestyle without giving up city convenience. It’s not just water activities and outdoor recreation; there is an active sports, arts, and cultural scene.

Takeaways for landlords in Jacksonville

Make sure your listing reflects the balance renters are looking for between lifestyle and work. Mention both proximity to employers and entertainment so your rental appeals to a wider audience.

Jacksonville renters are willing to move for better prices so set a reasonable rent. While they care about amenities, location, and features, the rent price is often what seals the deal.

Cincinnati, OH

| Renters | Homeowners |

|---|---|

|

|

Why renters are moving to Cincinnati

Cincinnati's lower cost of living compared to similarly-sized metros entices renters looking for affordability. A renter’s decision to move to the city is influenced by the stable economy with Fortune 500 companies, large healthcare systems, and the University of Cincinnati. Downtown neighborhoods remain popular due to their concentration of businesses, but areas near corporate offices and medical centers are gaining interest for their combination of affordability and job access.

The city’s arts scene has undergone a renaissance, transforming neighborhoods into creative corridors filled with galleries, music venues, theaters, boutiques, and independent restaurants and breweries. Combined with professional sport teams and never-ending green spaces, Cincinnati is not just a place to work, but a place to live.

Takeaways for landlords in Cincinnati

If you’re renovating your property, then choose your projects carefully; Cincinnati renters are practical and value functional upgrades over cosmetic changes. They want renovations that will make life easier and chores faster.

Columbus, OH

| Renters | Homeowners |

|---|---|

|

|

Why renters are moving in Columbus

Renters can build both careers and lives in Columbus. Ohio State University employs a lot of residents, with other businesses including Fortune 1000 companies. The job market spreads across a range of fields, from financial services and healthcare to retail, creating a resilient economic base.

In terms of lifestyle, the city is divided into districts that focus around a particular subject. The Discovery District is all about arts and culture while the Arena District centers around sports. This thriving job market and active lifestyle, combined with the affordable cost of living, encourages many to set down roots in Columbus.

Takeaways for landlords in Columbus

Each neighborhood has a different vibe, from bustling city centers to historic quaint corners. Give renters a preview of what their life will be like in your rental by describing the neighborhood atmosphere and its highlights in the property description.

Use descriptive language to paint everyday moments in your rental, like morning coffee in the sunlit living room or relaxing evenings on the porch as crickets chirp.

Overview of the Top 20 Cities for Landlords

| City | Average Rent | Home Listing Price | Monthly Mortgage |

|---|---|---|---|

| Saint Louis, MO | $1,126/month | $423,929 | $2,053/month |

| Baltimore, MD | $1,481/month | $410,925 | $1,990/month |

| Jacksonville, FL | $1,297/month | $380,349 | $1,842/month |

| Cincinnati, OH | $1,128/month | $451,326 | $2,186/month |

| Columbus, OH | $1,150/month | $508,824 | $2,464/month |

| Indianapolis, IN | $1,112/month | $380,645 | $1,843/month |

| Phoenix, AZ | $1,305/month | $615,306 | $2,980/month |

| Las Vegas, NV | $1,271/month | $561,570 | $2,720/month |

| Louisville, KY | $1,113/month | $366,287 | $1,774/month |

| Cleveland, OH | $1,337/month | $399,139 | $1,933/month |

| Charlotte, NC | $1,469/month | $547,249 | $2,650/month |

| Atlanta, GA | $1,610/month | $415,734 | $2,013/month |

| San Antonio, TX | $1,079/month | $361,205 | $1,749/month |

| Raleigh, NC | $1,365/month | $454,048 | $2,199/month |

| Philadelphia, PA | $1,738/month | $511,480 | $2,477/month |

| Kansas City, MO | $1,228/month | $430,525 | $2,085/month |

| Orlando, FL | $1,579/month | $405,414 | $1,963/month |

| Pittsburgh, PA | $1,396/month | $482,102 | $2,335/month |

| Fort Worth, TX | $1,256/month | $443,659 | $2,149/month |

| Sacramento, CA | $1,560/month | $715,270 | $3,464/month |

Let Apartments.com Highlight Your Location for You

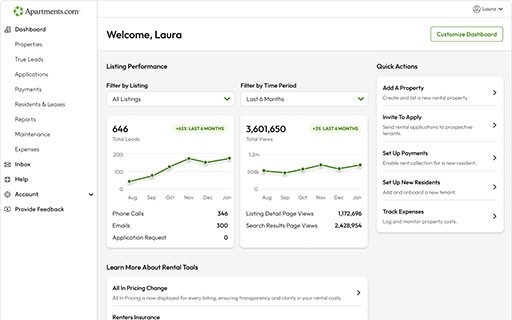

Location is second only to price in what renters care about most, but spelling out every nearby transit option, point of interest, school, and university takes time. When you list your rental on Apartments.com, all that information is automatically added to a dedicated section on your listing details page. Save time while still giving renters the location details they expect with Apartments.com.

FAQs

What if the average rent doesn’t cover the monthly mortgage?

Don’t worry if the average monthly mortgage isn’t covered by the average rent as these are averages at the end of the day. Rent is driven by the local market and the specific property. Factors like demand, comparable rentals, location, and condition determine what tenants are willing to pay.

Real estate is also a long-term investment, where future rent growth, market changes, and overall property value matter just as much as short-term monthly cash flow.

What is the best place to be a landlord?

There’s no single “best” place to be a landlord because the right market depends on the owner. Factors like budget, risk tolerance, property type, and how hands-on you want to be all matter. The best location is one where pricing, renter demand, and local laws align with your goals and management style.

What are red flags for landlords in a background check?

Red flags for landlords often show up during screening. Incomplete or inconsistent applications, unverifiable income or rental history, prior evictions, and resistance to background checks can all signal higher risk. While a single problem may have a valid reason, multiple red flags together often indicate large issues.