Renters insurance is being required by landlords more and more because of the protection it provides. It helps both landlord and tenant be prepared for anything unexpected they might face.

After learning about the benefits of requiring renters insurance, you’ve made your decision that your tenants must get it. Now you face the next step of how to require renters insurance and the details surrounding it.

Don’t jump in blind; the key to implementing renters insurance is knowing how to leverage it effectively, why you want to require it, what you want to gain, and the particulars of your situation. In order to figure this out, think about these questions:

Key Takeaways

- Landlords increasingly require renters insurance to limit risk: Liability coverage in renters insurance helps landlords avoid costly claims, lower their premiums, and shift responsibility for tenant-caused damage and injuries to the tenant's policy.

- $100,000 to $300,000 in liability coverage is standard: Landlords often require higher coverage limits based on factors like multi-unit buildings, geographic risks (e.g., flood/fire zones), and high-value amenities like hardwood floors or smart appliances.

- Enforcement hinges on clear lease language and proof of coverage: Landlords should require tenants to show a declarations page or certificate of insurance and list the landlord as an "interested party" to monitor lapses, which can trigger lease violation notices, fees, or even eviction.

What Is Tenant Liability Insurance Coverage?

Renters insurance covers personal property, personal liability, and additional living expenses. The tenant liability coverage portion protects tenants from financial or legal trouble if they cause any property damage or injury. While it seems like it is mostly beneficial for renters, it also protects you.

Why Landlords Require Renters Insurance

Landlords require renters insurance because it helps reduce claims, lower insurance premiums, reduce risk, and cover damage costs. In particular, the liability coverage is the most important part for landlords.

Protection against renter-caused damage

Renter liability coverage can pay for damage caused by negligence on the tenant’s part. Let’s say your tenant left the kitchen sink on and it flooded the apartment as well as the unit below. This led to damage to both units and the downstair neighbor’s personal belongings.

Since the property damage is due to the tenant’s negligence, renters insurance will cover specific costs under liability, including the downstair neighbor’s damaged belongings. It also helps cover the property damage that the tenant caused.

Legal and financial risk reduction

Renters insurance will also cover injuries to third parties, such as if a guest of your tenant slips on a wet floor and hurts themselves due to the tenant’s failure to maintain the apartment. The renters insurance will take care of any claims and legal issues faced by the tenant so it lowers your litigation risk.

What renters insurance doesn’t cover

Renters insurance is not landlord insurance; while landlords do benefit from requiring renters insurance, it lacks specific landlord protections. Issues unrelated to the tenant will not be covered, such as:

- Property damage that is not due to tenant negligence

- Landlord liability coverage

- Loss of rental income/non-occupied rentals

These items are usually covered by landlord insurance, which is why it is important that you get coverage, as well.

How Much Renters Insurance Should a Landlord Require?

Now that you know why you should require renters insurance, the question changes to how much you should require.

Common coverage amounts

Most landlords require $100,000 to $300,000 in liability coverage. However, depending on your situation, you may want to require a higher amount. Weigh the factors that influence the limit to pick the amount of coverage you want to require.

Factors that affect required limits

When trying to decide what coverage amount to require, you need to consider these factors:

- Property type (single-family, multi-unit): In a multi-unit building, property damage can spread from apartment to apartment. This can quickly lead to multiple parties being involved and higher costs, so requiring more liability coverage might be a good idea.

- Geographic risk (e.g., flood/fire zones): If your property is at greater risk of a natural disaster, then you might want to require a higher amount of coverage or additional coverage for floods or earthquakes.

- Amenities or high-value fixtures (e.g., smart appliances, hardwood floors): These more expensive property features cost more money to repair. If a tenant causes damage to these elements, you’ll want them to have sufficient insurance coverage to fully cover the loss.

How to Enforce and Manage Insurance Requirements

After you’ve figured out the coverage amount that you want your tenant to have, it’s time to enforce and manage that requirement. There are two main parts to this task: including insurance requirements in the lease and getting proof of renters insurance.

Lease language

Include the requirement for renters insurance and the specific coverage amount in the lease and be sure your tenant knows about them. The consequences of not having renters insurance should also be outlined.

Proof of renters insurance

To make sure that your tenant is complying with the requirement, ask for proof of renters insurance. The most common ways that landlords ask for renters insurance verification are:

- Declarations page

- Certificate of insurance

- Full policy document

- Confirmation from insurance company

You need to make sure that your tenant maintains their renters insurance throughout their lease period to ensure everyone is protected. One of the easiest ways is to ask your tenant to list you as an additional interest, sometimes called an interested party, on the policy. Being listed as an interested party means you will be notified if the policy is cancelled or lapses.

What Happens if Renters Insurance Coverage Lapses

In the lease, clearly outline the consequences of failing to obtain or maintain renters insurance and the subsequent process. This ensures transparency, enforceability, and defends against any legal issues. Here are some common steps to take in case of a coverage lapse.

Send a lease violation letter

Alert your renter that you are aware of the lack of renters insurance via a lease violation letter and that they need to fix the issue. Be sure to include the deadline, how they can show they’ve remedied the problem, and the consequences if they don’t take action.

Charge fees

Any fees or penalties that you charge for failing to have renters insurance must be written in the lease and follow related laws. Decide how much you want to charge and the frequency then write it into the lease.

Eviction

Eviction can be pursued if a renter cancels their policy or allows it to lapse as long as it is outlined in the lease. Make sure you follow each step of the eviction process and any related laws, like specific notices, notice periods, and proper legal steps.

Purchase renters insurance and charge your renter for it

If you’d rather not deal with extreme measures such as eviction, there is an alternative. You can purchase renters insurance for your renter and charge them for it. It must be written in the lease that you can do this, with all the details included such as the kind of coverage and that the renter will be billed for the cost.

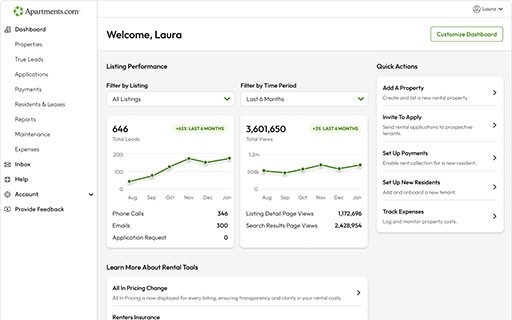

Complete the Renters Insurance Puzzle on Apartments.com

Knowing how much renters insurance you should require ($100,000–$300,000) is only one piece of the puzzle. To gain a complete understanding of renters insurance, explore the other pieces on Apartments.com; our vast knowledge and resource base will teach you all you need to know. From the benefits of renters insurance to the difference between it and landlords insurance, all your questions will be answered.

This article is intended for informational purposes only and does not constitute legal, insurance, or financial advice. Landlords should consult with a licensed insurance professional to ensure compliance with laws as well as take into consideration your property and situation.

FAQ

Can landlords require renter insurance?

Yes, landlords can include the requirement in the lease and request proof of insurance before move-in and at renewal. Be sure to check state laws as some have specific stipulations you must follow.

Are pets covered under renters insurance?

Pets are usually covered under the liability portion of renters insurance but it depends on the company. If you allow pets, ask your renters to make sure pets are covered or have them buy specific pet liability insurance.

What else is included in renters insurance?

Renters insurance is comprised of three main parts: personal property, liability, and additional living expenses. Personal property covers damage that happens to a tenant’s personal belongings. Additional living expenses kick in to pay for additional costs that occur because the tenant’s space is uninhabitable, like hotel costs.