Download our free Renters Insurance Letter Template

As a landlord, you’re juggling a lot—finding good tenants, managing property upkeep, and keeping track of your expenses. Renters insurance might not be top of mind, but it’s one of the best protections you can encourage your tenants to adopt.

Still, the idea of bringing up insurance—especially before a lease is signed—can feel risky. Will it scare off potential renters? Will it seem like an unnecessary cost? The truth is, renters insurance benefits both tenants and landlords, and introducing it doesn’t have to jeopardize your lease. Here’s how you can approach the subject with clarity, empathy, and confidence to create a win-win for you and your tenants.

Table of Contents

- What Is Renters Insurance?

- Including Renters Insurance in the Lease (or Not)

- Framing Renters Insurance the Right Way

- Final Thoughts: Making Renters Insurance a Win-Win

- FAQs

What Is Renters Insurance?

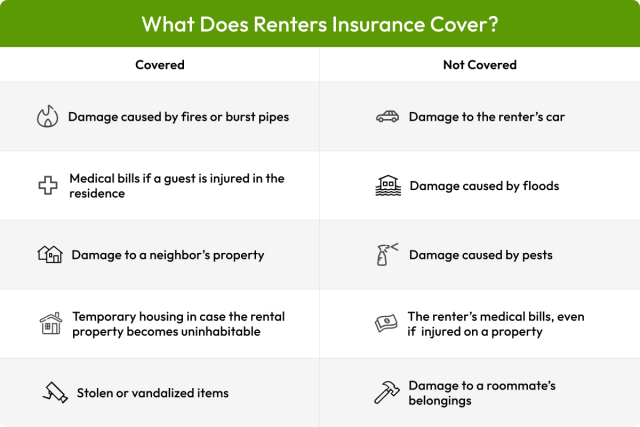

Renters insurance financially protects your tenants in case of emergencies like theft, natural disasters, and guests’ injuries for which they are held liable. A renters insurance policy will pay for replacement items in case of theft or damage, a tenant’s legal fees, or a guest’s medical bills if they were injured on the property.

What does renters insurance cover?

A renters insurance policy typically includes three types of coverage: personal property, liability, and additional living expenses.

Personal property coverage protects a tenant’s personal belongings in case of unforeseen events like theft, fires, or hail up to the policy limit. Personal property coverage limits usually range from $10,000 to $100,000.

Liability coverage protects a tenant financially in the event they are found liable for a guest’s injury or damage to another person’s property. Liability coverage will pay for medical bills, legal fees, and replacement items up to the policy limit. Insurance companies typically offer $100,000, $300,000, or $500,000 in liability coverage.

Additional living expenses (ALE) coverage, also known as “loss of use” coverage, protects a tenant if the rental becomes uninhabitable due to situations like fires, burst pipes, or theft that causes severe damage to the property. ALE coverage will pay for extra costs like hotel stays, pet boarding, or laundry services up to the policy limit. ALE coverage limits vary—they may be a specified dollar amount or a percentage of a tenant’s personal property coverage.

Landlord insurance vs. renters insurance

Like the names suggest, renters insurance protects renters, and landlord insurance protects landlords. Where renters insurance protects a tenant’s personal property in case of damage due to unforeseen events, landlord insurance protects the rental structure and any items that belong to the landlord. Where renters insurance pays for temporary housing in case the rental becomes uninhabitable, landlord insurance covers lost rental income.

Benefits of renters insurance for landlords

While renters insurance is primarily for renters, it protects landlords, too. A tenant’s renters insurance policy keeps you from being financially responsible for replacement items or temporary housing, and it reduces the risk of a lawsuit. This can give you peace of mind and allow for a smoother landlord-tenant relationship.

Including Renters Insurance in the Lease (or Not)

Even though renters insurance is not required by law, it’s standard for property managers to require renters insurance in their lease. If you choose to make renters insurance a lease requirement, be clear and consistent. Include a clause about the renters insurance requirement in your lease and discuss it with renters during tours.

Making it optional vs. required

You may be torn between recommending renters insurance and requiring it outright. Both approaches can work, depending on your comfort level and the type of property you manage.

If you’re not ready to mandate renters insurance, consider promoting it as a highly recommended best practice. This gives tenants flexibility while still educating them on the benefits. You can highlight it during showings, in your rental listing, and in your welcome materials.

Including a renters insurance clause in your lease

Many experienced landlords find that requiring coverage sets a professional tone and attracts responsible renters. Just be sure to check your state and local laws, as some jurisdictions may have limitations on what can be mandated.

On Apartments.com, you can create and personalize lease agreements that are state-compliant and legally-binding. Our lease creation tool is free to use and allows you to include requirements like renters insurance.

Framing Renters Insurance the Right Way

If you choose not to require renters insurance in your lease, it’s still a good idea to recommend it to your tenants.

Finding the best way to bring up renters insurance with new or prospective tenants is all about understanding the renter’s point of view. Renters may be hesitant to invest in renters insurance because they don’t know why they need it or if it’s worth the cost. Helping your tenant see renters insurance as a benefit, not a burden, is critical to ensuring you’re both protected from events you can’t predict.

Emphasize tenant protection

When introducing the idea of renters insurance, shift the spotlight away from your own protection and onto your tenants’ wellbeing. Many renters assume their landlord’s insurance covers their belongings, but it doesn’t. By educating them on what renters insurance actually provides, you’re helping them avoid costly misunderstandings.

Explain how renters insurance can:

- Replace personal items lost to fire, theft, or water damage

- Cover temporary living expenses if the rental becomes uninhabitable

- Protect them from liability if someone gets injured in their home

Reassure them that this coverage is a safety net, not just a legal formality. When tenants understand the benefits, they’re far more likely to view the insurance as a responsible choice.

How to position it as a standard best practice

Renters insurance is common for property managers to require, and framing it as a widely adopted best practice helps normalize the request. Position it alongside other standard rental expectations, like paying rent on time or respecting quiet hours.

Mention that many large apartment communities and landlords require it, and that it reflects a responsible renting standard—not a sign of mistrust. When you ask for renters insurance verification at multiple points, framing it the same way can help tenants feel better. This approach helps reinforce your professionalism while putting the tenant at ease.

Sample phrasing and email scripts

Recommending renters insurance in a friendly, informative way can be hard. Here’s an email script you can use to break the ice:

[Property Address, Unit Number]

[City, State, Zip]

[Today’s Date]

Hi [Name of Renter],

I wanted to share a quick tip that could save you a lot of stress in the future: renters insurance. While I don’t require it, I highly recommend getting coverage in case of unexpected events like fire or theft.

Renters insurance protects you, your belongings, and your peace of mind. Most policies are very affordable ($10-20/month) and cover things like property damage and temporary housing if needed. I can recommend some trusted providers if you’re not sure where to start.

Sincerely,

[Your Signature]

[Your Full Name]

[Your Phone Number or Email]

If your renters need more information about different types of insurance, the Renterverse blog addresses common renter questions and challenges.

Handling pushback with empathy

It’s not uncommon for renters—especially first-time renters or those on tight budgets—to hesitate when renters insurance is brought up. They might see it as an unnecessary expense or a cash grab. When that happens, your response matters.

Start by listening. Ask why they’re hesitant, and then offer gentle clarification:

“I totally understand—it feels like one more thing. But renters insurance actually protects you more than me. If there’s ever a fire or a burst pipe, my landlord insurance policy won’t replace your things or cover a hotel stay. This policy makes sure you’re covered when it counts.”

Avoid turning it into a power struggle. Instead, share examples, offer resources for affordable policies, and explain that it’s about safety and peace of mind. Offering flexibility, like a grace period to show proof of coverage, can also ease concerns while reinforcing your professionalism and care as a landlord.

Final Thoughts: Making Renters Insurance a Win-Win

Renters insurance may feel like a small detail in the grand scheme of property management, but it can make a significant difference in protecting you and your tenants. Whether you choose to recommend it or require it in your lease, the key is to communicate its value with empathy and clarity.

When tenants understand that renters insurance isn’t about mistrust, they’re far more likely to see it as a benefit. With the right approach, you can make renters insurance a standard part of your rental process without losing a lease—or a good tenant.

FAQs

Can I buy renters insurance for my tenant?

No, a landlord cannot buy renters insurance for a tenant. However, you can include a renters insurance clause in your lease agreement and require tenants to provide proof of coverage before they move in.

What does renters insurance not cover?

While renters insurance provides a safety net for a lot of unexpected events, it doesn’t cover everything. Renters insurance typically doesn’t cover floods, earthquakes, pest damage, building damage, or damage caused by pets.

Does renters insurance cover pets?

A renters insurance policy’s liability coverage may cover legal fees or medical expenses if a tenant’s dog bites someone or damages a neighbor’s property. However, a renters insurance policy typically will not cover damages a tenant’s pet causes to the property they’re renting.

It’s important to note that many renters insurance policies exclude exotic pets or commonly restricted dog breeds like pit bulls or Rottweilers.