Thinking about taking on property management as a side gig? Renting out a property can be a great source of income, but it’s not without challenges. Here are some key considerations to think about before deciding whether it’s worth buying rental property.

What Is an Investment Property?

An investment property is real estate that you buy with the intent of turning a profit, either by renting or flipping the home. Unlike a primary residence, an investment property is a business venture that requires investors to analyze the potential risks and returns.

Investing vs. buying

Buying a home as a primary residence is a personal and financial decision, while investing in property to rent out is a business decision. Buying a property to rent out typically requires higher mortgage rates and down payments, and landlords have to pay income taxes as well as property taxes.

Should You Invest in a Rental Property?

While investing in a home to rent out is a great way to build wealth, it’s not for everyone. Consider your lifestyle and finances before deciding to invest in real estate.

Here are some pros and cons of investing in real estate to consider.

Pros of Owning a Rental Property

Monthly income

Renting out a property is a source of passive income. Many private landlords manage a property in addition to a full-time job, allowing them to take home some extra pocket change.

Tax deductions

According to the IRS, private landlords can deduct necessary expenses like mortgage interest, property depreciation, property maintenance, property taxes, and insurance. When you file your taxes, deducting these expenses willlower your tax bill or increase your return.

Property value appreciation

While the IRS allows you to deduct property depreciation, making upgrades and renovations to a property can increase its value. This allows you to charge higher rent, increasing your profit.

Cons of Owning a Rental Property

Property taxes

In addition to income tax, landlords also must pay property taxes on their rental property. Property tax rates vary by county, so contact your local tax assessor to find out how much you’ll pay in taxes on a rental property.

The good news is that you can deduct property taxes from rental income when you file your tax return. However, most states’ property tax due dates don’t align with the tax return due date, so you likely won’t see the benefits of your income tax deduction for months after you pay property taxes. This leaves you with less income in the meantime, so many landlords will incorporate property taxes into their rent prices to help them break even faster.

Vacancies

Rental vacancies can significantly impact your bottom line. With no stream of income from rent payments, monthly expenses and maintenance costs will dwindle previous profits. Tenant turnover costs can also rack up quickly, with expenses from advertising, screening, and cleaning and repairs.

Vacancies can lead to other risks like theft, vandalism, squatters, water damage, or fire. It’s important to take precautions like installing a security system and maintaining your property’s heating system to protect your investment.

Property management

While the IRS classifies rental income as passive income, property management is still a job.

Before a tenant even moves in, landlords must list and advertise their property, hold tours and open houses, accept applications and screen tenants, and prepare the property for a new tenant by making any necessary repairs and upgrades. While the rental is occupied, landlords must perform regular maintenance on the rental, collect rent, manage rental expenses, and keep an open line of communication with tenants.

Maintenance

Property managers are responsible for routine maintenance and repairs that are necessary due to normal wear and tear. While your rent price should cover regular maintenance costs, emergency maintenance can result in unexpected expenses. Managing maintenance requests can also be time-consuming, regardless of whether you hire contractors or perform the maintenance yourself.

Financial risk

Like any financial endeavor, there’s a level of risk associated with owning and managing rental properties. You can lose money if your tenants don’t pay rent on time, and a recession can lead to more vacancies. Unexpected repairs can run up your expenses, so building an airtight budget is important to protect yourself financially.

Tenant management

Managing tenants can be hard, even if you pick renters with perfect rental and credit history. The reality is that tenants can be difficult, and you might not know a renter is hostile and uncooperative until they move in.

While it’s okay to have personal opinions about your tenants, it’s important to remain professional. Document every incident and remind your tenants of the expectations outlined in the lease agreement. If the tenant continues to violate the lease after multiple warnings, eviction may be necessary.

10 Things to Consider Before Investing in Real Estate

Your financial situation

Before you get your heart set on a rental property, consider whether you can actually afford to invest in real estate. How much can you reasonably afford to spend on a down payment, closing costs, and repairs and upgrades? It takes a while to turn a profit from a rental, so it’s important not to bite off more than you can chew.

Your personal finances will also impact loan terms. Mortgage rates for rental properties are already higher than rates for primary residences, and a low credit score will only hike those rates higher. According to Experian, loan applicants with a FICO score of at least 760 will get the lowest interest rates .

Mortgage terms

Financing a rental property is different from financing a primary residence, mainly in the qualification criteria. Because real estate investment is a business venture, lenders see mortgages for rental properties as higher risk and will typically require a higher down payment and higher interest rates compared to loans for primary residences.

According to Experian, landlords can expect interest rates between 7.22% to 7.845% for a 30-year fixed-rate conventional mortgage, as opposed to the 6.97% rate for primary residences. According to Quicken Loans, most lenders require at least a 15% down payment for an investment property, while down payments on primary residences can be as low as 3%.

It’s important to note that paying a higher down payment can lower your mortgage rate. Consult with a loan counselor to explore options tailored to your finances.

Location

A rental property’s location informs everything, from property taxes to your target market. Before you choose a property, do some market research into your area to get a better idea of what renters look for. Nearby landmarks like schools and major employers will directly impact your target market and can help you figure out what kind of rental to invest in.

Based off your analysis of your local market, what features and amenities are most common in rented units? What renovations and upgrades should you invest in once you buy a property? While you can’t call out demographics in your listing or deny applicants based on protected characteristics—doing so violates the Fair Housing Act and could get you in legal trouble—you can strategically renovate and market your property to attract tenants.

Market conditions

It’s important to understand the current real estate and rental market before investing in property. Keep an eye on how interest rates and property prices are changing to get the best deal and maximize your profits. The Wall Street Journal reports that while home prices and mortgages rates are still high, the rising inventory is giving buyers the upper hand in negotiations.

But you need tenants once you buy a rental property, so it’s crucial to look into your area’s vacancy rate for rentals. If the vacancy rate is high, you’ll be competing with other property managers for a limited number of renters.

Monthly expenses

A rental property isn’t a one-time investment; you should account for monthly expenses like utility bills, landlord insurance, mortgage payments, and HOA fees before purchasing a rental property. Before you buy a property, research the average cost of these expenses in your area so you can accurately assess a property’s profitability.

Surprise expenses

No matter how well you keep up with your property’s maintenance needs, you can’t always predict a burst pipe or a blown fuse. Because emergency maintenance needs affect your rental’s habitability, you’re financially responsible for any repairs. It’s important to have a financial cushion just in case.

Rent and ROI

Assessing whether a property will be profitable is one of the most crucial parts of property management. Before you even invest in a property, consider whether you’ll turn a profit after purchasing the property and paying monthly expenses.

Setting an appropriate rent price is one of the most crucial parts of listing a rental. If you set your rent too low, you risk losing money by covering expenses out of your own pocket. If you set rent too high, you risk driving away potential tenants. Our rent comp reports can help you price your rental competitively by comparing your property to similar properties in your area, and our ROI Calculator can help you assess whether your investment property will be profitable at a competitive rent price.

Tax implications

Renting a property out can impact your taxes positively and negatively, so research the property taxes in your area before you invest in rental property.

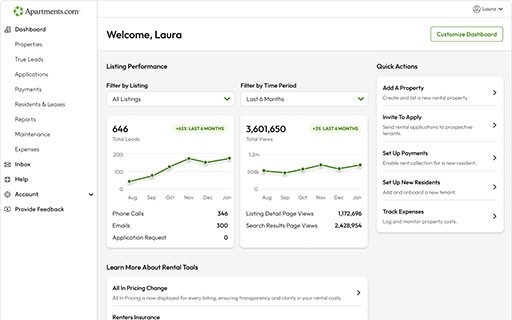

On the flip side, you’ll get a tax break when you file your income tax return each year. You can write off most expenses, which decreases your taxable income and will lower your tax bill. Apartments.com’s Rental Manager allows you to track and manage your expenses, sorting them into tax categories to make tax season much smoother.

Depreciation

In addition to property taxes and income taxes, landlords should be aware of depreciation recapture. Depreciation recapture is essentially a tax the IRS collects when you sell a property higher than its book value.

For example, say you rent out a single-family home worth $400,000 starting in January 2025. You rent it out for seven years before selling it for $350,000. According to the Modified Accelerated Cost Recovery System (MACRS), your rental depreciated by 3.485% in 2025, then by 3.636% for the following six years. This means that your property was depreciated by a total of $101,212 over the seven years you rented it out, leaving a book value of $298,788. Since you sold the property for $51,212 over book value, the IRS views that as a capital gain and will tax it at a maximum rate of 25%.

The good news is that you can make depreciation work for you by claiming a deduction when you file your taxes each year. Following the example above, your property depreciated by $13,940 in the first year. When you file your taxes in the spring of 2026, you can deduct that from your rental income to lower your taxable income.

Legal responsibilities and liabilities

Arguably the most important part of property management is legal responsibility. There are several federal landlord-tenant laws to know before you start renting out a property. Lack of familiarity with these laws can get you into legal trouble.

Fair Housing Act

The Fair Housing Act (FHA) prohibits property managers from discriminating against tenants based on race, color, religion, nationality, sex, familial status, or disability. Landlords cannot deny an applicant based on these protected characteristics, apply different terms or privileges based on protected characteristics, call out protected characteristics in a listing, or implement blanket policies that target or exclude specific demographics.

Landlords must only approve or deny an applicant based on objective criteria like employment status, income, and credit score and must apply the same house rules to all tenants.

Fair Credit Reporting Act

According to the Fair Credit Reporting Act (FRCA), renters have the right to know if anything in their credit report is being considered against them in the screening process, allowing them to dispute any inaccuracies before you decline their rental application.

To remain transparent and compliant with the FRCA, adverse action notices are a good practice to implement before sending a rejection letter. Download our free adverse action letter template to make sure you're FRCA compliant.

Implied warranty of habitability

The implied warranty of habitability is a legal precedent that requires landlords to provide tenants with safe and sanitary living conditions. The exact definition of habitable conditions varies by state, but landlords are generally required to address mold, pest infestations, leaking roofs, and heating.

State and local laws

Each state has its own landlord-tenant rules and regulations, typically around security deposit usage, rent increases, habitable conditions, and notices for both landlords and tenants. Familiarize yourself with your state’s landlord-tenant laws to make sure you’re legally compliant.

Is Rental Property a Good Investment?

Property management isn’t for everyone, so assess your lifestyle and personal finances to determine if rental property is a good investment for you.

If you decide to take the next steps, Apartments.com can help. When you list your property with Apartments.com, your listing will automatically appear on five additional websites. Listing with Apartments.com also gives you access to the Rental Manager suite, where you can create a lease, screen tenants, collect rent, manage maintenance requests, and more.

This article is for informational purposes and should not be construed as financial or investment advice. If you need advice, please contact a real estate attorney or tax professional in your area.