Managing rental properties can be financially rewarding, but it also comes with responsibilities, including calculating and paying taxes on the rent payments you receive from tenants. Whether you’re renting out a single-family home, an apartment, or a vacation property, you are required to include all rental income on your tax return. Fortunately, deductions, which include the costs associated with maintaining and managing the property, can ultimately lower your tax liability.

Understanding how rental income is taxed is crucial to staying compliant with tax regulations and optimizing financial outcomes. This guide breaks down key elements involved in calculating taxes on rental income to help you stay on top of your tax obligations.

- What counts as rental income

- What doesn’t count as rental income

- Common Tax Deductions for Rental Property Owners

- Calculating taxable rental income

- Tax rates and filing requirements for rental income

- Maximize rental property tax deductions with smart record-keeping

- When you should consider hiring a tax professional

What Counts as Rental Income

Rental income includes the payments you receive from tenants for the use of your property. It goes beyond just monthly rent. Any advance rent, security deposits that are used as rent, or payments for ancillary services like parking or utility fees that are paid directly to you are also considered rental income.

Additionally, if any tenant covers costs that normally fall to you, such as property repairs, those amounts should be reported as income. Knowing what qualifies as income ensures that you accurately capture your total earnings.

What Doesn’t Count as Rental Income

Not all money exchanged between you and your tenants counts as income. For example, refundable security deposits are generally not counted as rental income. These funds are treated as a form of collateral to cover potential damages or unpaid rent, and as long as the landlord returns the deposit to the tenant at the end of the lease, it is not considered income. However, if part of the deposit is retained to cover expenses like repairs or cleaning fees after the tenant moves out, the amount withheld would then become taxable income.

Common Tax Deductions for Rental Property Owners

A wide range of operating expenses can offset your taxable rental income. These include mortgage interest, property taxes, insurance, repair and maintenance costs, and property management fees. Money that you paid for a background check (tenant screening) is also deductible.

Travel costs tied to performing maintenance, conducting inspections, or meeting with tenants are often tax-deductible. These travel deductions can include fuel costs, mileage, parking fees, and even airfare if the property is located far from your primary residence. Additionally, fees paid for professional services, like hiring legal counsel to handle lease agreements or settle disputes, may also qualify as deductible expenses.

While the cost of improvements (such as remodeling a kitchen, adding a patio, etc.) is a capital expense that is required to be depreciated over time, small repairs like repainting, fixing minor leaks, or replacing a broken toilet can often be written off entirely in the year they were completed. Being aware of available deductions such as these and others can help maximize your tax savings.

Calculating Taxable Rental Income

To determine your taxable rental income, start by totaling all rental income you received for the year. This includes any pre-paid rent payments. Pre-paid rent can only be claimed as income within the same year you received the funds.

Next, subtract all qualified deductible expenses. The resulting number is your taxable rental income. For example, if you received $20,000 in rental income from your tenants but spent $6,000 in eligible deductible expenses, your taxable income would be $14,000. Your tax filing status will then determine your tax rate on the $14,000.

Tax Rates and Filing Requirements for Rental Income

Your taxable rental income is generally taxed at the same rates as regular income, meaning it’s subject to your marginal income tax bracket. If you’re a sole proprietor or own the property personally, you will report this income on your individual tax return (usually Schedule E of IRS Form 1040).

If you are operating as a business entity, such as an LLC, specific filing requirements and tax implications may apply, so it’s important to align with the regulations for your chosen business structure.

Maximize Rental Property Tax Deductions With Smart Record-Keeping

Accurate record-keeping is a crucial responsibility, especially when it comes to tax filing. A significant benefit of maintaining well-organized records is the ability to maximize deductions. There are numerous tax benefits, but they can only be claimed with proper documentation.

Tracking expenses such as property maintenance, insurance premiums, and depreciation allows you to fully leverage these deductions, reducing your tax liability. Keeping receipts, invoices, and bank statements ensures every eligible expense is accounted for, maximizing financial returns during tax season. The IRS recommends maintaining your records for at least three years after you file taxes.

Beyond compliance and tax savings, precise record-keeping ensures financial clarity. An organized approach will help you track cash flow, forecast expenses, and assess profitability more effectively. This can be particularly beneficial for long-term planning, such as budgeting for property upgrades or expanding a real estate portfolio.

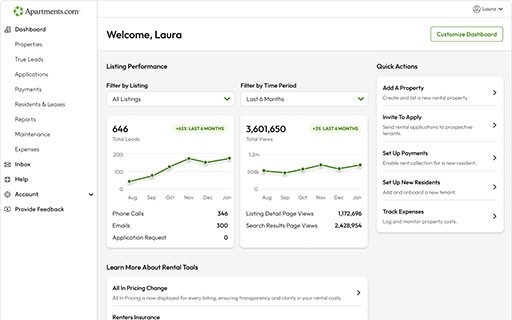

Keeping your records organized also makes it easier to address any financial disputes or inquiries promptly. Apartments.com has free rental tools that provide an easy way to track expenses and help ease the burden of tax filing.

When You Should Consider Hiring a Tax Professional

Tax regulations can evolve from year to year, introducing new deductions, altering filing requirements, or changing how income is reported. Without the proper expertise, staying current with these updates can be challenging, and overlooking even a minor change could lead to compliance issues. Tax professionals monitor these developments and apply the latest rules to your situation, helping you avoid penalties and potentially uncovering new opportunities to save money.

The more properties you own, the more extensive and complex your financial records become, increasing the likelihood of errors or missed deductions. Tax professionals are skilled at organizing and analyzing these records, ensuring you can claim every eligible deduction while meeting reporting obligations. Whether it’s streamlining record-keeping or preparing strategies for growing your portfolio, their expertise can strengthen your financial position and significantly reduce the stress of managing tax responsibilities.

Finally, if you’re uncertain about any part of the tax calculation process, consulting with a tax professional can save time and money while ensuring compliance with the law. A proactive approach will help you manage your rental property finances with confidence.

The above information is in no way intended to be a substitute for qualified tax advice. If you need tax advice, please contact a tax professional in your local area.