Evaluating your current or future rental property’s profitability is the key to your success, whether you’re an established or aspiring landlord. So, understanding the average vacancy rate helps landlords figure out their property’s return on investment. The vacancy rate is the percentage of units in a rental property that are unoccupied at a specific time.

In the past couple of years, the vacancy rate in the U.S. has been on an upward climb. As of Q1 2025, the average vacancy rate for apartments is 7.8 percent in major U.S. metropolitan markets, according to CoStar Group.

In general, a high vacancy rate is a sign that a lot of units are vacant in a market while low vacancy rates mean that a lot of apartments are rented. To truly understand the average vacancy rate, you need to know what it means, how it’s calculated, and how to keep it low before making any decisions.

While the vacancy rate is an important indicator of the state of the market, it should not be the only one you consider. You need the full context before making any decisions.

Table of Contents

- What affects the vacancy rate?

- How has the average vacancy rate changed recently?

- U.S. metropolitan areas with the highest vacancy rates

- U.S. metropolitan areas with the lowest vacancy rates

- Tips for landlords on how to reduce vacancy rates

Key Takeaways

- Our proprietary data shows that the average vacancy rate in early 2025 was 7.8%, only increasing 0.2% YoY.

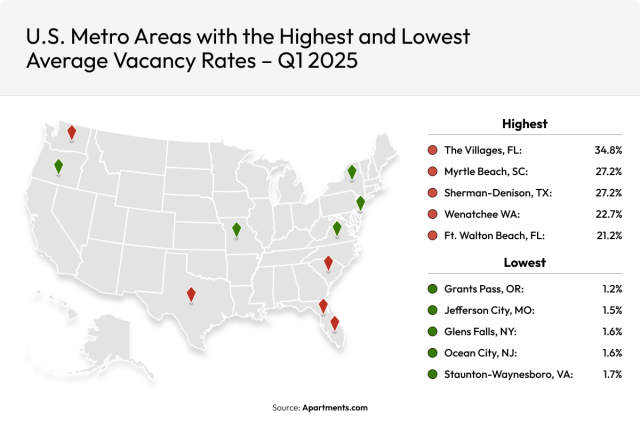

- In early 2025, the U.S. metropolitan area with the highest vacancy rate was The Villages, FL at 34.8%.

- In early 2025, the U.S. metropolitan area with the lowest vacancy rate was Grants Pass, OR at 1.2%.

What Affects the Vacancy Rate?

Knowing what affects the vacancy rate is important because it helps you identify the reason for the percentage. This gives you a better indication of what is happening in the market and whether you should invest there or not. The top factors that influence the vacancy rate are:

- Supply: oversupply can cause vacancy rates to increase, such as new construction flooding the market, even if there is a lot of demand. A low supply can lead to low vacancy rates.

- Demand: strong demand reduces vacancy rates. Even high demand can’t win out over a high supply, sometimes causing high rates.

- Population trends: an increase in population can drive demand and lower vacancy rates while a decreasing population can push vacancy rates up.

- Economic conditions: areas with a strong economy and job growth attract people, lowering vacancy rates.

- Location: desirable locations with good infrastructure and sought-after features (such as schools, grocery stores, and transit access) often have lower vacancy rates.

How the Average Vacancy Rate Has Changed

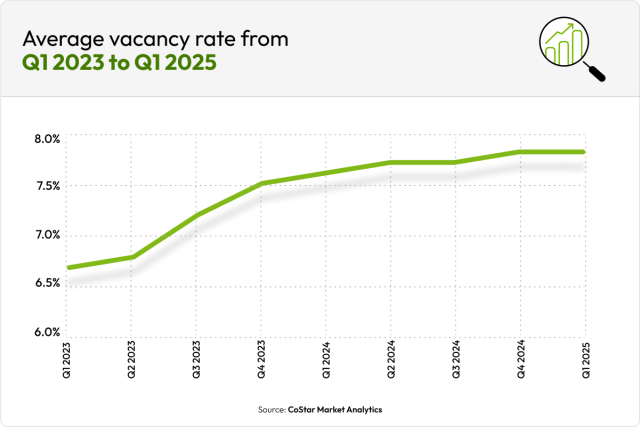

Over the past two years, the average vacancy rate in Q1 has been:

- Q1 2025: 7.8 percent

- Q1 2024: 7.6 percent

- Q1 2023: 6.7 percent

These numbers show that the average vacancy rate has increased. From 2023 to 2025, the vacancy rate jumped by 1.1 percent. From 2024 to 2025, there was not as sharp an increase, but it still rose by .2 percent.

- YoY 2024-2025: .2 percent

- YoY 2023-2025: 1.1 percent

However, this rise in vacancy rate is not because of low demand, but the exact opposite. High demand has caused a lot of new construction to enter the market, leading to oversupply. Demand for apartments is growing at a quick pace for several reasons:

- Many people are choosing to rent forever instead of buying a home

- Strong economic growth

- Desire to move back to major cities

- High home prices, elevated interest rates

Jesse Gundersheim of CoStar News says, “The U.S. apartment vacancy rate finally peaked at the end of last year and is forecast to maintain downward momentum through 2025 and beyond. […] While rental demand is still growing at an above-average pace, supply additions are projected to fall about 45% this year based on a quickly thinning under-construction pipeline that should help vacancies recede.”

This will affect landlords in many ways but it all points to favorable conditions for you. You'll have an easier time finding tenants and face less competition, making for a more enjoyable and profitable landlord experience.

U.S. Metropolitan Areas with the Highest Vacancy Rates

Vacancy rates can vary from region to region. A high vacancy rate doesn’t instantly mean that it is a risky place to invest in a rental property. The vacancy rate is only one piece of the puzzle, and you need to get the entire picture.

One way that a high vacancy rate could be a positive sign for investors is if there’s an oversupply of apartments due to increased new construction driven by strong demand. This demand would mean an apartment would get rented quickly, especially if you make your rental property stand out.

A not so promising place could have an oversupply because of an outflow of people and very few coming in. You would likely have trouble finding someone to rent your apartment.

Thoroughly evaluating the market is the key to finding the best place to buy rental property. But checking out the areas with the highest vacancy rates could uncover a diamond in the rough that can become a profitable investment with the right strategy.

1. The Villages, Florida

- Average vacancy rate (Q1 2025): 34.8 percent

- Average rent (Q1 2025): $1,733/month

Multifamily was not pronounced in The Villages until 2020 and it has rapidly gained steam. Though demand is strong, the community struggles to keep up with the fast rate of new rentals being built leading to it taking the number one spot on metropolitan areas with a high vacancy rate. The vacancy rate rose a shocking 9.6 percent YoY compared to Q1 2024, when it was 25.2 percent.

Job and population growth

Though The Villages is known for the master-planned retirement community of the same name, people of all ages are moving to The Villages. The area saw a huge spike in population growth in 2022, with a 7.5 percent YoY growth. While it has leveled out a bit, many people are still moving to the city as the 2024 to 2025 YoY growth was 1.6 percent, far ahead of the U.S.’s average population growth of 0.9 percent.

Retirees want to enjoy the amazing retirement community while younger generations follow job creations. Major employment sectors have seen a large increase, like education and health, which grew 9.73 percent YoY.

What landlords need to know

As new construction is still being planned and underway, the vacancy rate may remain high in The Villages. However, the high demand means that a rental property in The Villages could still be a good investment, especially with all the new townhomes, low-rises, and mid-rises you could invest in.

2. Myrtle Beach, South Carolina

- Average vacancy rate (Q1 2025): 27.2 percent

- Average rent (Q1 2025): $1,622/month

The vacancy rate in Myrtle Beach continues to rise. It has increased seven percent YoY compared to Q1 2024, when it was 20.2 percent. That’s mainly due to a surplus of new supply driven by high demand, which has spurred increased construction and, in turn, led to a higher vacancy rate.

The market has been quite active, but the new supply has driven the vacancy rate to record heights. Construction consists of mostly high-end builds from luxury apartments to modern townhomes.

Job and population growth

Population and job growth have driven the increased demand for rentals. Myrtle Beach’s population has grown by more than four thousand people in the past four years, according to the Census Bureau. In 2020 it was 35,973 and in 2024 it was 40,535.

The Bureau of Labor Statistics says that jobs in Myrtle Beach increased four percent YoY. Tourism and hospitality are major employment sectors because of the area’s natural beauty as well as renowned annual events, like Carolina Country Music Fest and the World Famous Blue Crab Festival. Other industries have made giant leaps in growth such as aviation, aerospace, and manufacturing.

What landlords need to know

Vacancies in Myrtle Beach are expected to fall due to the continued population and job growth as new construction slows down. If you become a landlord in Myrtle beach, pay close attention to the vacancy rate as it is projected to decrease, allowing you to raise the rent when the time is right.

3. Sherman-Denison, Texas

- Average vacancy rate (Q1 2025): 24.8 percent

- Average rent (Q1 2025): $1,251/month

As the economy in Sherman-Denison is anchored by major employers, the demand for housing has risen. This demand has been met with a wave of supply of low- and mid-rise apartments that have increased the vacancy rate. It has increased 14.8 percent YoY compared to Q1 2024, when it was nine percent.

Job and population growth

Job creation in Sherman-Denison remains strong, as the YoY job growth percentage rose 0.7 percent from Q1 to Q2, according to CoStar Group. New manufacturing factories opening are expected to produce thousands of jobs. Due to this, rental demand is expected to continue at a steady pace and eventually catch up with supply.

What landlords need to know

When advertising your rental property, consider what those job seekers are looking for in an apartment so you can feature those elements. This includes proximity to work, access to major roads, and nearby services (grocery stores, banks, etc.).

4. Wenatchee, Washington

- Average vacancy rate (Q1 2025): 22.7 percent

- Average rent (Q1 2025): $1,717/month

Wenatchee is seeing a high vacancy rate as new construction pushes it up. Compared to Q1 2024 when it was 8.4 percent, the vacancy rate increased 14.3 percent YoY to 22.7 percent. High-end apartments are sitting vacant as that is the majority of what is being constructed. However, the rental vacancy rate is expected to recover as the construction slows.

Job and population growth

Rentals are leasing at a steady pace, showing the potential of owning a property in Wenatchee. In the past few years, retirees and remote workers have flocked to the city for a rural lifestyle. 2024 saw a large spike in population growth YoY, with the peak being in Q3 2024 at 1.26 percent (the national average was .98 percent).

What landlords need to know

Though younger, remote workers have moved to Wenatchee, the region still is primarily older. According to CoStar, 90 percent have lived in the same home for more than a year, so offering long-term leases and rent concessions for those longer periods is sure to be a hit.

5. Fort Walton Beach, Florida

- Average vacancy rate (Q1 2025): 21.2 percent

- Average rent (Q1 2025): $1,771/month

Renter demand in Fort Walton Beach has grown significantly recently, but it still lags behind the pace of new supply as evident by the high vacancy rate. New construction is slowing so demand should catch up, as proven by the vacancy rates leveling off. From Q1 2023 to Q1 2024, the vacancy rate rose 57.4 percent; from Q1 2024 to Q1 2025, it only increased by 4.2 percent.

Job and population growth

The demand is driven by the population and job growth fueled by an increase in jobs in government, military, real estate, finance, professional services, and hospitality services. In 2023, the Census Bureau found that 15.2 percent of the workforce worked in educational services, healthcare, and social assistance.

The Eglin Air Force Base employs more than 74,000 people, drawing many active military members to Fort Walton Beach. The population stands strong because of this inflow but also because 25 percent of the area’s population are retired military personnel who have chosen to stay in the area.

What landlords need to know

Depending on where you look for a property in Fort Walton Beach, you’ll find different types. Condos, garden-style apartments, and mid-rises are the primary option on Okaloosa Island, making these the perfect option for landlords wanting to own a vacation rental. It’s mostly townhome in the city limits of Fort Walton Beach where year-round residents live, if you’re looking for long-term renters.

U.S. Metropolitan Areas with the Lowest Vacancy Rates

Low vacancy rates are an indication of a good place to invest, but you need to find out more about the market before making your final decision. It could also be an indication of slow growth in the area.

Usually, a low vacancy rate is a positive sign that there is so much demand there aren’t many unoccupied units. Narrow down where you’re choosing your next rental location by investigating areas with the lowest vacancy rates.

1. Grants Pass, Oregon

- Average vacancy rate (Q1 2025): 1.2 percent

- Average rent (Q1 2025): $1,255/month

Grants Pass has a low vacancy rate because there are very few rental properties and almost no new construction, but healthy demand. The vacancy rate is even decreasing — it dropped by 0.2 percent YoY compared to Q1 2024, when it was 1.4 percent.

Even though the city is growing, new construction is almost non-existent because of a lack of viable land, high costs, and restrictive zoning laws and regulations. These present significant barriers to projects, so there have only been one or two new developments recently.

This has caused prices across the board to spike upwards so while higher rent prices are good, the expensive purchasing prices are not as beneficial to investors. However, there is potential for high profits, especially with the growth the city is experiencing.

Job and population growth

An influx of people has led to growth in both population and demand. Many are drawn by the health, education, and health services industry. The Census Bureau reported that the industry employed the largest percentage of people in 2023 at 25.2 percent.

What landlords need to know

Modern and well-maintained rentals are in high demand in Grants Pass as many of the available rentals are older. Investing in upgrades, getting newer amenities, and being responsive when it comes to maintenance is a sure-fire way to get inquiries flooding in and retain tenants.

2. Jefferson City, Missouri

- Average vacancy rate (Q1 2025): 1.5 percent

- Average rent (Q1 2025): $725/month

Because of no new construction, the average vacancy rate in Jefferson City remains low. However, with the downtown revitalization project completed and the city focusing its efforts on creating more affordable housing, growth is expected. This is shown by the vacancy rate starting to decrease as it dropped 0.1 percent YoY compared to Q1 2024, when it was 1.6 percent.

Job and population growth

While the population has largely remained stable, there has been some growth as seen by the population growth YoY staying consistent for the last couple of years.

What landlords need to know

Though single-family homes are the primary residence type in Jefferson City, apartments and other multifamily options are becoming increasingly popular. Renters and single-person households are moving to the city, and current households are choosing to rent because of affordability.

3. Glen Falls, New York

- Average vacancy rate (Q1 2025): 1.6 percent

- Average rent (Q1 2025): $1,282/month

Glen Falls has a low vacancy rate right now, but that may change as there is a lot of new construction underway. This is shown by how the vacancy rate has risen in the past year. It increased 0.4 percent YoY compared to Q1, 2024, when it was 1.2 percent.

Job and population growth

The rising vacancy rate is due to an increased demand for rentals. People are attracted to the thriving city because of the affordability, small-town lifestyle, and efforts to improve the area the city is making. The Glen Falls Downtown Revitalization Initiative is nearly complete, and more improvements are planned. Developers recognized this interest and responded by starting several townhome garden and low-rise projects.

What landlords need to know

Many people move to Glen Falls because of its proximity to the Adirondack Mountains and Lake George as well as the revitalization efforts. Its location makes it the perfect home base for year-round renters wanting to be near outdoor recreation (hiking, skiing, boating, etc.).

4. Ocean City, New Jersey

- Average vacancy rate (Q1 2025): 1.6 percent

- Average rent (Q1 2025): $1,285/month

As a small market, Ocean City has a low vacancy rate due to little new construction and inventory. From Q1 2024 to Q1 2025, the vacancy rate only decreased by 0.1 percent YoY. However, Ocean City is a popular tourist destination.

Job and population growth

Though overall job and population growth are low, the economy is highly seasonal. The summer months see a flood of visitors that boost business in the area. CoStar reports that the real estate market stays strong with rising home prices and high demand for both primary and vacation properties.

What landlords need to know

During the summer you will be able to charge rent prices that reflect that high demand. Highlight desirable summer amenities in your listing to attract both the seasonal and year-round renters. The real estate market is competitive in Ocean City so finding the right place can be challenging.

5. Staunton-Waynesboro, Virginia

- Average vacancy rate (Q1 2025): 1.7 percent

- Average rent (Q1 2025): $1,374/month

The vacancy rate has seen a sharp drop in recent years as there has been little construction in Staunton-Waynesboro recently. The general downward trend of the vacancy rate is expected to continue with slight fluctuations. The vacancy rate increased 0.3 percent YoY compared to Q1 2024 when it was 1.4 percent.

There is plenty of demand as shown by the jump in rent prices. In Q1 2024, the average rent was $1,252 and it increased 9.8 percent to $1,374 in Q1 2025.

Job and population growth

Even during recent times of economic uncertainty, job growth rate has held steady, YoY in Q1 2025 was 0.7 percent and in Q1 2024 it was 0.4 percent. This signifies a stable market that is resistant to volatile changes.

What landlords need to know

Purchasing a rental close to highways or major businesses is sure to attract renters as the area’s prime location and strong economy are what draw people to the area.

Tips for Landlords on How to Reduce Vacancy Rates

Dealing with vacancies is no fun for any landlord. You have to find a new tenant and manage vacancy costs, like lost income, turnover costs, and advertising expenses. The best way to reduce vacancies is to employ strategies that attract and retain tenants.

Attract quality tenants with effective marketing

Knowing what renters want and leveraging that information to advertise your property effectively increases your chances of attracting the right tenants. Tenants who are serious apartment hunters want high-quality photos, detailed property descriptions, 3D tours, and videos. These tenants are more likely to be long-term renters, meaning you won’t be facing vacancies any time soon.

Thoroughly screen potential tenants

After you optimize your rental listing, narrow down your pool of applicants by conducting tenant screening. This is an important step in finding responsible and trustworthy renters. Taking the time to properly screen tenants means you’ll find one who will stick around so you don’t have to deal with vacancies or tenant turnover.

Tenant screening on Apartments.com is your one-stop shop where you will get all the information you need about a potential renter. Information about tenants will be gathered in one report, including:

- Eviction

- Criminal history

- Credit history and risk

- Employment and address history

Offer incentives to fill vacancies

Rent concessions are a great way to stand out from competition. It is a special that landlords offer to attract potential tenants, like offering free first month’s rent or a waived security deposit. Apartment hunters are much more likely to inquire about an apartment with a rent concession, especially if it is a free first month.

You can also use rental concessions to increase tenant retention by giving them a reason to renew their lease. By filling unoccupied units and keeping tenants in your property, you lower your vacancy rate.

Keep tenants satisfied

Keeping tenants in your rental means less vacancies and more income. One of the most effective methods is to make sure they are satisfied. There are many things you can do:

- Quickly address maintenance

- Be flexible

- Show your appreciation to your tenants

- Build a good landlord/renter relationship

- Keep a well-maintained property

- Maintain quality and open communication

- Listen to and implement feedback

Streamline your operations

Streamlining your operations means you’ll minimize the time your unit sits empty and enhance your tenant’s experience. Whether you’re in the process of leasing or managing tenants, there are many ways you can increase your operational efficiency.

For example, when you create a lease template that you customize and re-use for each tenant, you cut down on the amount of time it takes you to lease. This gets new tenants into your rental faster, meaning you can start earning rental income faster. There are many ways you can streamline your operations, from applications to tenant turnover.

Methodology

Both the vacancy rates and average rents are from CoStar Group. As the leading authority in commercial real estate information, analytics, and news, CoStar has been trusted by real estate professionals for more than 37 years. Job and population data is from a combination of CoStar data and the Census Bureau.

Help Boost Your Property’s Success by Paying Attention to the Average Vacancy Rate

Understanding the average vacancy rate provides valuable insights into your property’s performance and the rental market. Whether you’re deciding where to invest or determining the profitability of your property, the vacancy rate can guide you.

Just remember that you should use it in conjunction with other metrics as a high or low average vacancy rate doesn’t instantly mean risky or safe. You don’t have to collect or determine all these metrics by yourself; Apartments.com is here to help you out with rent comp reports.

You’ll get a personalized rent comp report on Rental Manager containing extensive information on rent trends, vacancy rates, and more. These reports provide key information, so you have a deeper understanding of your property and the market.

Average Vacancy Rate FAQs

How do I calculate vacancy rate?

It’s easy to calculate the vacancy rate. All it takes is one equation:

-

Vacancy Rate = (Number of Vacant Units in the Property ÷ Total Number of Units in the Property) × 100

The number you get from the equation is the vacancy rate expressed as a percentage.

Why is the vacancy rate an important metric for landlords?

The vacancy rate is an important metric for landlords because it assists in evaluating where to invest in rental property. It also impacts rental income and profitability like the return on investment. Tracking the vacancy lets landlords make confident choices that lead to success.

What’s an acceptable apartment vacancy rate?

An acceptable apartment vacancy rate is usually between five and 10 percent. This range suggests a strong rental market where demand is high enough to limit vacancies while still allowing for some turnover.