How are multifamily communities today building their advertising strategy? The latest survey from Apartments.com offers a glimpse into the advertising choices made by today’s multifamily decision-makers. The survey represented 16,000 properties and over 1.6 million units.

From marketing goals to operational challenges, the survey revealed how your peers are developing their marketing strategies and where they’re choosing to allocate their resources.

Here are the top advertising trends to watch.

Quality beats quantity

Multifamily advertisers are looking for leads — but not just any leads. High-quality leads are the top marketing outcome that advertisers look for when weighing their advertising options.

In fact, a full 70 percent of decision-makers identified high-quality leads as an important outcome. In comparison, only 24 percent consider a high volume of leads to be a top priority.

“We focus on channels that drive qualified renters, not just traffic,” said one respondent, a marketing manager responsible for 19,000 units.

And it’s no wonder that lead quality matters. A whopping 72 percent of respondents cited low-quality leads as a primary operational concern this year.

Across the nation, multifamily properties are facing high vacancy and low or negative rent growth. These concerns are especially strong in Sun Belt markets and among new construction properties in the top price point. Low-quality leads can waste time spent by leasing teams, and delays in filling vacancies further reduce revenue.

This makes it especially important that leads convert to residents.

In fact, 78 percent of respondents said that meeting or exceeding their occupancy goals is one of their top marketing goals this year. In second place, 65 percent cited improving their lead-to-lease conversion rate.

Marketing budgets aren’t budging much

Tough market conditions for multifamily are compounded by limited budgets. About half of properties this year are facing a flat or lower marketing budget compared to last year, while only 44 percent have seen their marketing budget grow for 2025.

It’s the largest properties that have been the most likely to face budget cuts. While only 7 percent of respondents overall reported a shrinking budget, 17 percent of those responsible for properties with 400 or more units did so.

Among those with properties of 5 to 150 units, the majority have seen budgets remain flat.

And for properties that fall somewhere in between — with over 150 but under 400 units — a slight majority have seen budgets increase. Within this property size, 54 percent have reported having a larger marketing budget in 2025.

When budgets are limited, multifamily marketers have to be more conscious than ever of where their dollars are going — and what the return looks like.

“With budgets under pressure, we track cost-per-lead and return on spend across every platform,” said the same marketing manager responsible for 19,000 units.

Decision-makers are looking to maximize their return without exceeding their budgets.

An operations leader responsible for nearly 1,600 units described this year’s top challenge as “being the most visible property online while staying within budget.”

Property managers play an important role in decision-making

Who decides the advertising strategy for a property or portfolio? A wide variety of roles are involved in decision-making, from leasing agents and property managers all the way up to marketing and operations leaders and property owners.

In many cases, these multifamily professionals are responsible for deciding both the advertising sources and the budget. In other cases, they select the tools but not the budget — or vice versa.

Leasing agents, for example, rarely influence the marketing budget — even when they’re involved in selecting advertising sources. In contrast, property owners are the multifamily professionals most likely to set the marketing budget without selecting the specific advertising sources.

Property managers, who represented 40 percent of survey respondents overall, made up a greater share of decision-makers among properties with 20 or more units.

In contrast, owners of smaller properties tend to be more involved in the advertising strategy. For properties with fewer than 20 units, property owners represented the largest decision-making population. Among this segment, owners typically decide on both budget and strategy. For larger properties, owners — when involved — often influence the budget but not the advertising tools.

Internet listing sites come out on top

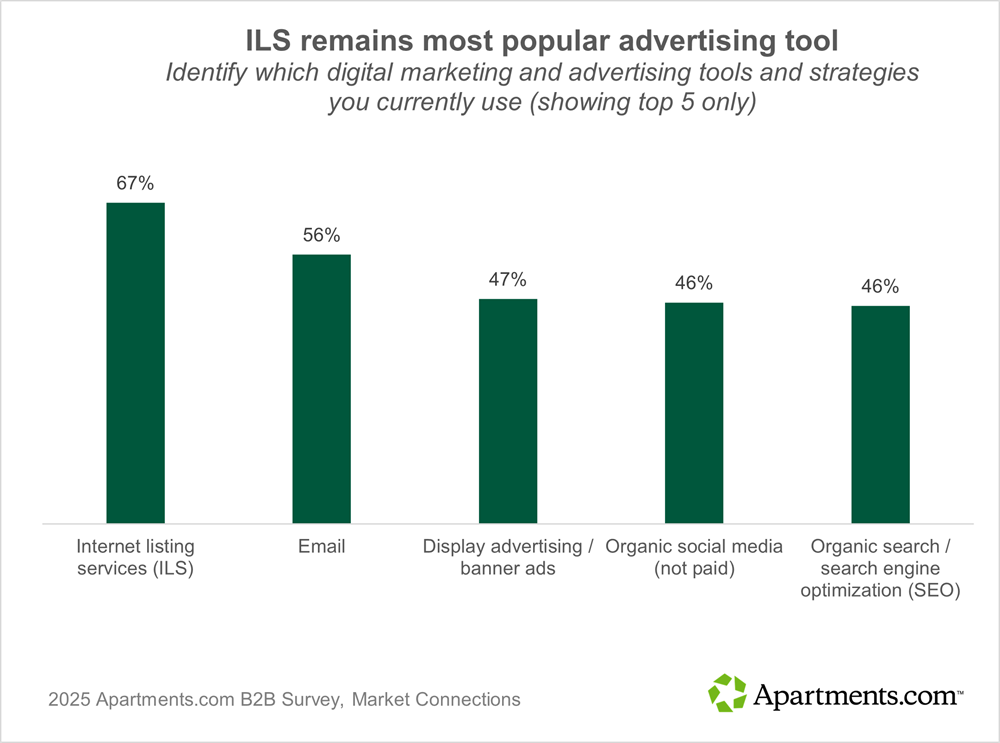

The most popular tool for multifamily marketing is the internet listing service, or ILS. Nearly 70 percent of respondents reported currently using an ILS.

The ILS comes out ahead of other popular strategies, including email (56 percent), displaying advertising (47 percent), and organic social media (46 percent).

This may be an undercount, however — because 74 percent reported using Apartments, the leading ILS, within the past six months. This suggests that ILS usage is even higher.

The ILS also comes out on top among surveys of prospective renters. The latest survey from Apartments.com found that 76 percent of renters said they’re currently using or planning to use an ILS (rental search site or app) to find their next place.

“Renters generally have a place they go to for their apartment searches,” explained a property owner with 53 units.

Large properties rely on more and higher-tech advertising options

Overall, respondents report using an average of four different advertising tactics. For example, they might use an ILS alongside email marketing and social media. But advertising strategies vary by property size.

Larger properties tend to use more approaches than their smaller counterparts. Most properties of 100 or more units use four to nine advertising tools. In comparison, the majority of decision-makers responsible for properties under 100 units said they used one to three approaches.

Large properties are more likely than smaller properties to rely on online video, AI-generated marketing, SMS, geofencing, and email.

But some strategies remain popular across the board. The usage of internet listing services, social media, and SEO are generally unaffected by property size.

Get personalized help with your advertising strategy

Looking to optimize your marketing strategy? Talk to an Apartments.com sales associate to learn what advertising options are right for your properties’ needs and goals.

Looking for more advertising insights?

Explore these helpful resources: