How do smaller apartment communities compete without big budgets or large teams? A recent survey by Apartments.com reveals how decision-makers for properties under 50 units set marketing goals, choose advertising tactics, and make every dollar count.

Apartments.com’s 2025 advertising survey reflects the marketing strategies of multifamily decision-makers nationwide, with respondents representing over 1.6 million units and 16,000 properties ranging from five units to over 600.

Owners play an active role in advertising strategy

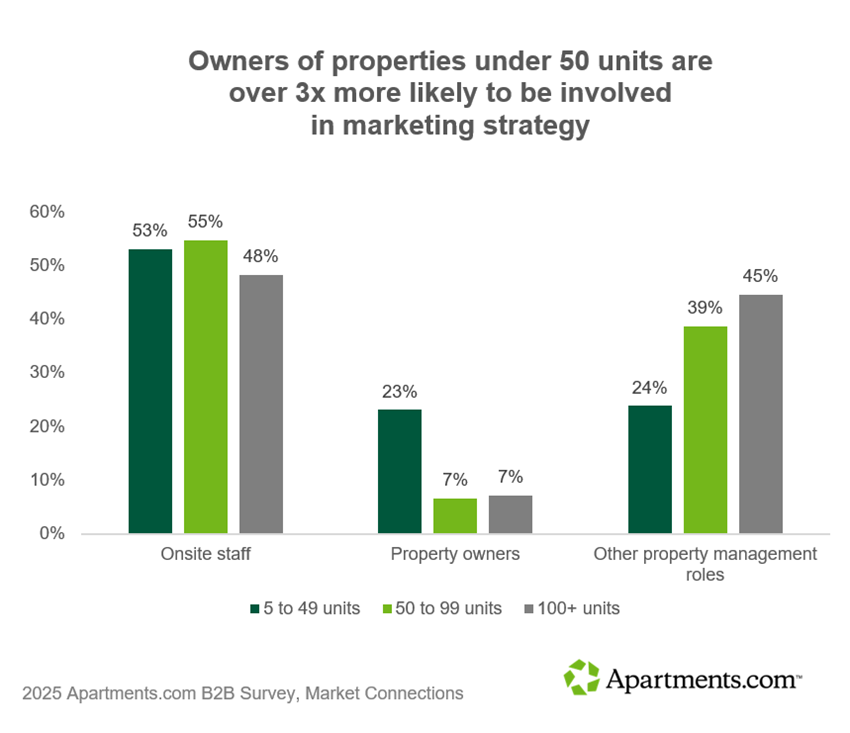

Among properties of all sizes, onsite staff are the most likely to be involved in advertising strategy. These team members, who include property managers, community managers, and leasing staff, influence marketing strategy by recommending advertising sources and sometimes also budget allocations.

But among properties with fewer units, the survey revealed, owners are significantly more likely to play an active role in determining advertising strategies.

While 53 percent of decision-makers in the under–50 units segment are onsite staff, a notable 23 percent are owners — that’s significantly higher than for larger properties. In fact, among smaller properties, owners are over three times more likely to be involved in advertising strategy, compared to properties with 100 or more units.

The remaining 24 percent of advertising decision-makers are multifamily professionals in other management roles, such as regional managers and marketing directors.

When owners of small properties participate in advertising strategy, they’re not just setting the budget. Nearly three-quarters are involved in determining both how and how much to spend, compared to 13 percent who only influence selections and another 13 percent who only determine the budget.

Every dollar counts

For properties with fewer units, budgets are modest and cost considerations are top of mind. Overall marketing spend per property is about eight times smaller for properties with under 50 units than it is for those with 100 or more units.

The median monthly spend per property under 50 units is just $200, according to the survey. That’s compared to $1,600 for properties with 100 or more units. Smaller properties have fewer units to generate revenue, which limits how much they can invest in marketing. As a result, these properties report lower usage of all advertising strategies compared to larger properties.

As one property manager, responsible for three properties, explained, “We want to make sure we spend money effectively and hopefully spend less.”

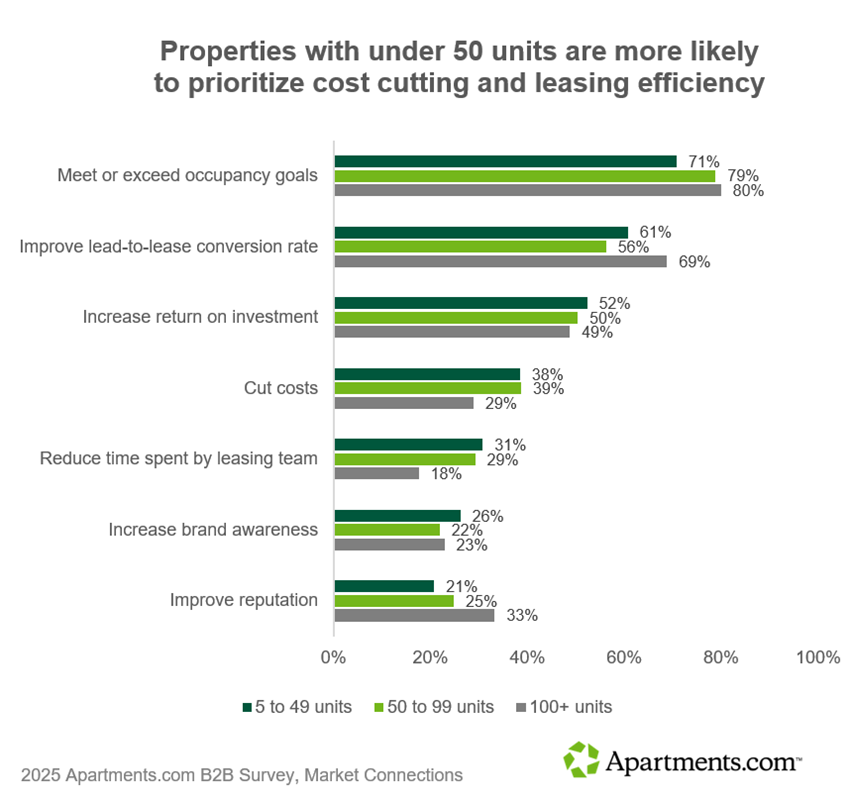

This budget-conscious approach is reflected in marketing priorities as well. Properties under 50 units are more likely to prioritize cost cutting, with 38 percent of respondents citing this marketing goal as a priority this year, compared to only 29 percent of respondents with properties of 100 or more units.

The same proportion of respondents identified insufficient budget as a major operational concern for the year.

Consequently, decision-makers for properties in this segment have to weigh their advertising options carefully, with a keen eye on performance. Instead of spreading their advertising dollars across a variety of channels, these decision-makers invest in the options most likely to produce a return.

“We balance costs versus what we will gain,” said another property manager responsible for three small multifamily buildings.

Lead quality and conversion are the most important considerations for these decision-makers as they evaluate advertising options. Three-quarters of respondents responsible for small properties cited high-quality leads as a top advertising outcome, followed by high lead-to-lease conversion with 60 percent of respondents.

Generating applications is also a top consideration, ranking third after lead quality and conversion. Nearly half of respondents representing properties under 50 units cited this outcome as a priority. This outcome was considered slightly more important in the smaller segment than among larger properties.

As a result, decision-makers for this segment are significantly less likely than larger properties to report using strategies considered less effective. Compared to those with the largest properties, these respondents were 46 percent less likely to report using pay-per-click advertising and 66 percent less likely to report using geofencing.

Small teams highlight the need for efficiency

The smaller the properties, the leaner the teams. Properties with under 50 units are the most likely to cite leasing efficiency as a top marketing goal. Thirty-eight percent of respondents in this segment said they’re looking to reduce time spent by their leasing team, compared to only 29 percent of respondents in the 100+ segment.

At the same time, smaller properties are also more likely to consider limited staff bandwidth to be a major operational concern, with 31 percent of respondents in this segment identifying this as one of their top three concerns for the year. That’s compared to only 18 percent of their peers representing properties with 100 or more units.

Social media plays a smaller role

Social media isn’t just for large properties — but properties with fewer units have fewer resources to devote to this advertising channel.

Overall, 38 percent of decision-makers for properties with under 50 units report that their properties or brand have social media channels. That’s nearly half as many as in the 100+ segment, where 65 percent of respondents said their properties have social media channels — but still a sizable share.

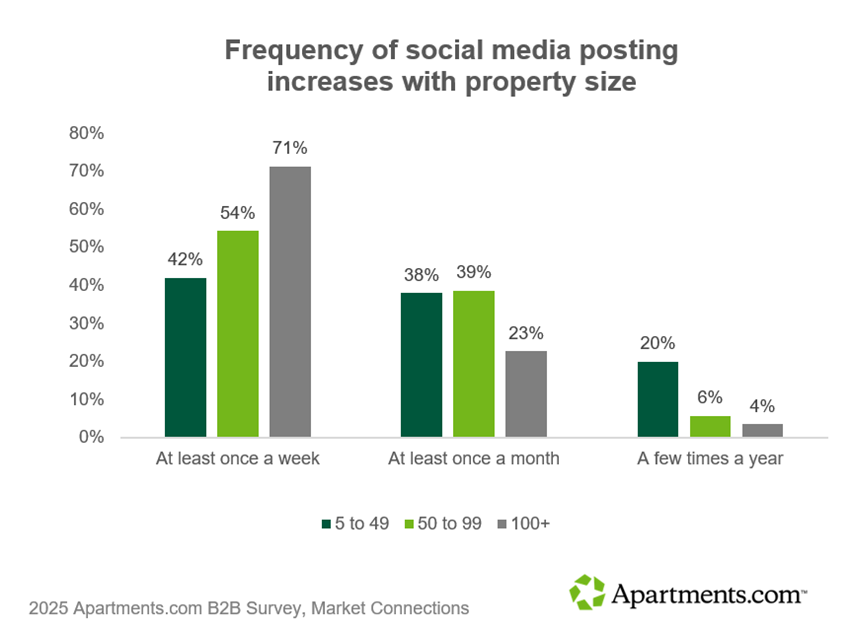

How often do properties typically update their social media channels with new posts for prospective and current residents? The industry recommendation is to post at least once a week, but the majority of smaller properties fall short of this goal.

While 71 percent of respondents with properties of 100 or more units say their social media channels are updated at least once a week, only 42 percent of respondents with smaller properties indicated the same.

The majority — 58 percent — update their channels anywhere from a few times a month to a few times a year.

While the use of social media channels isn’t as common in this segment, other types of social media advertising options are popular, with somewhat comparable rates to properties of other sizes. Overall, 42 percent of those with properties under 50 units say they use organic social media and paid social media in their advertising strategy. In fact, paid social media ranks as the third most popular advertising strategy for this segment, whereas it came in fifth place for properties with over 100 units.

Ratings and reviews matter, but reputation management is a lower priority

A strong reputation can drive revenue and occupancy. But for properties with fewer units, this consideration can lag behind other priorities.

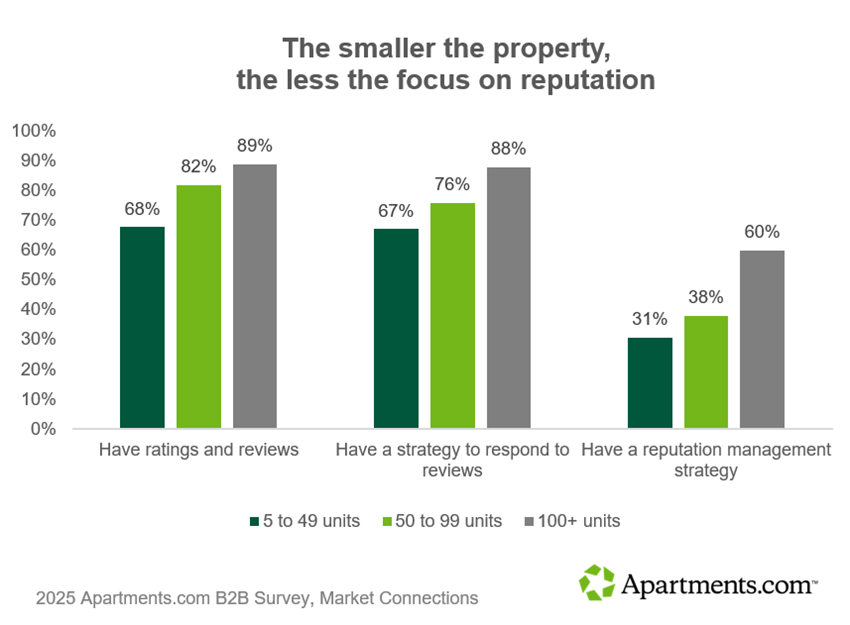

When it comes to top marketing goals, smaller properties are 38 percent less likely than their larger peers to prioritize improving their reputation. Only one in five decision-makers for properties under 50 units cited this as a top priority.

Smaller properties are also half as likely as their larger peers to have a reputation management strategy in place, with only 31 percent reporting that they do so.

But that doesn’t mean these properties don’t pay attention to their ratings and reviews.

Over two-thirds (68 percent) of respondents said their properties under 50 units have ratings and reviews, and 53 percent said they’re satisfied with these ratings.

Two-thirds of smaller properties with ratings and reviews said they have a strategy in place to regularly respond to reviews, compared to 88 percent of properties with 100 or more units.

How are your competitors advertising?

For more insights from Apartments.com’s advertising survey, check out these resources:

- Lead Quality Remains Top Priority for Multifamily Marketers

- How Multifamily Communities Manage Social Media and Online Reputation

Looking for more tips to inform your property’s marketing approach? Get the top marketing tips for properties with under 50 units: