Transparent pricing has been a hot topic since the White House’s statement against rental junk fees—unexpected fees not advertised in a rental listing—in July 2023. While fees are common practice in the rental industry, the push for transparent pricing to become a standard landlord responsibility encourages an honest approach to advertising a property.

Table of Contents

- What is Transparent Pricing?

- Why Price Transparency Matters

- What to Know About Apartment Pricing Policy

- List Your Property Confidently with Apartments.com

- FAQs

What is Transparent Pricing?

Transparent pricing, also called “all-in pricing,” means that a property manager advertises the total cost of a rental in the listing, including monthly rent and fees, for a specified lease length.

Here are some costs price transparency pushes landlords to disclose in a listing:

- Base rent

- Application fees

- Security deposits

- Utility fees

- Amenity fees

- Pet fees

- Parking fee

- Rent concessions

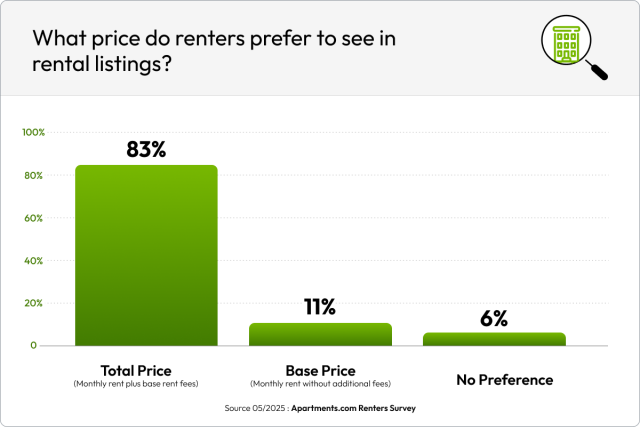

According to Apartments.com’s May 2025 renter survey, 83% of renters would prefer to see the total price including all fees over just the base rent. The survey also revealed that 57% of renters would stop considering a rental if fees made the total cost higher than originally advertised. This means that price transparency isn’t just a preference—it keeps hidden fees from driving renters away.

Why Price Transparency Matters

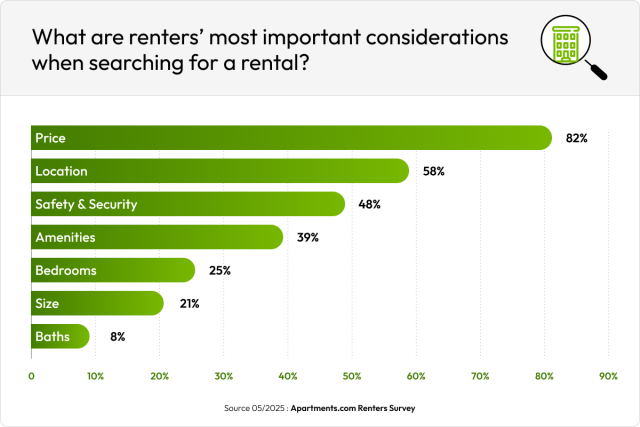

Price remains one of the most important factors in a renter’s search. According to Apartments.com’s May 2025 renter survey, 82% of renters rank price in their top three most important considerations when selecting their next residence. This soars above location (58%), safety (48%), and amenities (39%).

With price being the most important factor in a renter’s decision, renters want to know what they’ll pay for a rental before they invest time in tours, applications, and reading leases.

Price transparency allows renters to make more informed decisions in the search for their next place and encourages honesty between landlords and renters. Rent prices typically don’t include the cost of utilities, amenities, or pet fees, and newer renters may not know that. Breaking down your fees in your property listing can help you avoid heated conversations or legal disputes with renters.

Benefits of transparent pricing for renters

Disclosing fees upfront simplifies the rental search by minimizing the amount of time a renter spends clarifying prices.

How price transparency helps renters:

- Save time. Disclosing fees upfront helps renters determine whether they can afford the total cost of a rental before they take the time to go on a tour.

- Stick to a budget. Renters can more effectively build a budget when they know exactly how much they’ll pay for rent and fees each month.

- Compare properties easily. Renters can evaluate multiple properties while considering the total price of each.

- Avoid surprises. No one likes hidden fees, especially not after falling in love with a rental only to find that the actual cost is significantly higher than what’s listed.

Benefits of transparent pricing for landlords

While price transparency helps renters avoid investing time in a rental they won’t be able to afford, it also helps landlords avoid problems with tenants.

How price transparency helps landlords:

- Attract more qualified renters. Because renters can see exactly what they’ll pay, you’re less likely to receive an application from a tenant who won’t be able to pay the full cost each month.

- Reduce miscommunication and disputes. Showing fees in your listing can avoid heated discussions with frustrated renters.

- Encourage transparency from renters. Honesty can go a long way, especially in a competitive market. A trustworthy property listing can help you stand out and set the precedent for an honest landlord-tenant relationship.

- Protect you from legal disputes. Disclosing fees in your listing can safeguard you from allegations of Fair Housing Act (FHA) violations. If a renter accuses you of imposing discriminatory fees, you can present proof that all fees were in your property listing and therefore are not unique to specific renters. FHA compliance is required by law, but it also ensures that you’re an ethical landlord.

What to Know About Apartment Pricing Policy

Recent legal precedents and state laws have set the scene for price transparency in the rental industry, so laying out your fees in your property listing can help you get ahead of the curve.

The rental industry is still new to price transparency, so it’s important to stay up to date on the newest developments to make sure you’re compliant with laws and listing platform regulations.

Be aware of federal, state, and local laws

On May 12, the FTC’s Rule on Unfair or Deceptive Fees went into effect. This regulation originally applied to short-term lodging and ticketed events, but the FTC and the Colorado Attorney General filed a complaint against a large multifamily property management company at the beginning of this year that extended the regulation to apply to residential rentals.

In addition to federal regulations, fee transparency has taken off on the state level. Most states have some sort of regulation around the disclosure of fees in a lease agreement, but so far, only four states have passed laws requiring property managers to advertise the total monthly cost of their property in a listing:

- Massachusetts (effective Sept. 2, 2025)

- Connecticut (effective Oct. 1, 2025)

- Minnesota (effective Oct. 1, 2025)

- Nevada (effective Oct. 1, 2025)

- Colorado (effective Jan. 1, 2026)

Georgia and Illinois have also introduced legislation requiring landlords to advertise the nonoptional fees, but no legislation has passed yet.

To stay updated on the latest active legislation, check the National Low Income Housing Coalition database for regulations in your area.

Know listing platform requirements

Each listing platform has different requirements around what landlords are and are not required to disclose. While Apartments.com doesn’t have any disclosure requirements outside of state regulations, showing a breakdown of your nonoptional and optional fees can help you attract more qualified renters.

If you’re new to the rental game, apartment pricing software can help you figure out how much to charge for rent and fees. Apartments.com’s rent comp reports compare your property to others like it in the same area to give you an idea of the local market. From there, you can set an appropriate rent price and monthly fees.

Methodology

Apartments.com’s May 2025 renter survey was conducted online and distributed via email to recent users of Apartments.com. Data from the survey was collected from 20,018 respondents who currently live in the U.S. and plan to rent their next residence within two years.

List Your Property Confidently with Apartments.com

With price being renters’ biggest concern, transparent pricing can help you stand out. Listing all your fees in the Fees & Policies section of your listing can attract qualified renters, protect you from legal disputes, and set the tone for an honest landlord-tenant relationship.

Apartments.com makes price transparency easy. When you list your property through the Rental Manager dashboard, you have the option to list fees in your property description. Once you publish your listing, your property will be visible to thousands of renters.

FAQs

Are landlords required to disclose all costs?

Yes, most states require landlords to disclose all fees in the lease agreement. So far, four states—Colorado, Connecticut, Massachusetts, Minnesota, and Nevada—have passed laws that will require landlords to advertise the total monthly cost of their property in the listing.

What breakdown of fees should landlords show in a listing?

To be fully transparent with renters, landlords should show all one-time and recurring fees in their property listing. This includes but is not limited to application fees, utility fees, parking fees, and pet fees.

What does “base price” mean?

“Base price” refers to the monthly rent price without any fees added. The base price is what property managers typically show in a property listing, but some state legislation will soon require landlords to advertise the total monthly cost.