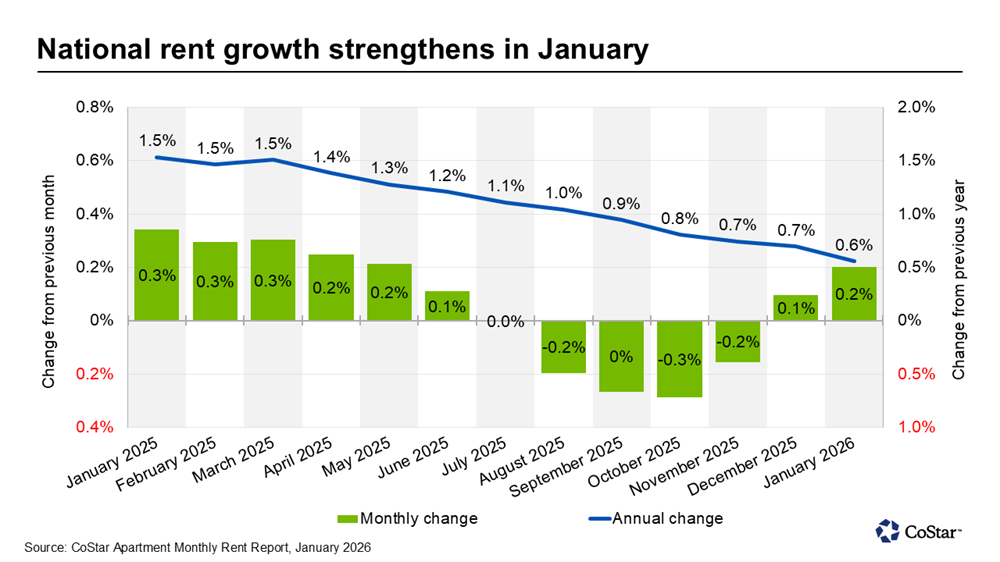

National multifamily rents continued the positive trendline that began in December, according to the latest CoStar data. Rents grew year over year by 0.6 percent, bringing the national average asking rent to $1,713. At the monthly level, rents edged up slightly over December by 0.2 percent.

While modest, this positive trendline reflects the gradual easing of oversupply conditions. Prior to December, the multifamily market had seen five months of flat or declining rents month over month.

Midwest retains lead, thanks to limited supply

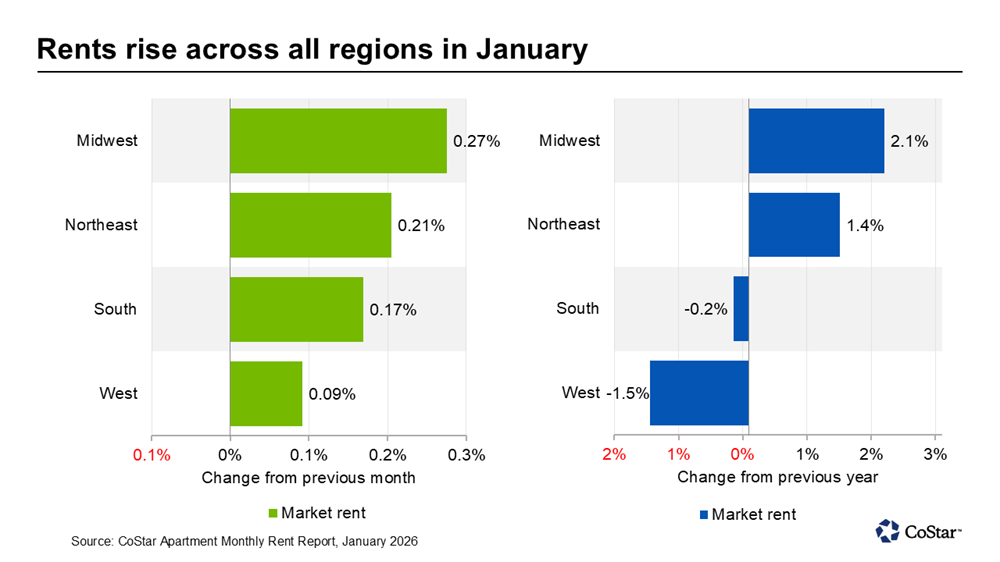

The regional trends that characterized the market for the past few years continued, with the Midwest posting the strongest rent growth nationwide. In the Midwest, rents grew 2.1 percent year over year, followed by the Northeast at 1.3 percent. Both of these regions have seen relatively healthy balances of supply and demand.

In Chicago, the capital of the Midwest, rents grew annually by 2.3 percent.

At the other end of the scale, both the South and West saw annual rent growth fall into negative territory, with the South posting negative 0.2 percent rent growth and the West negative 1.5 percent.

At the monthly level, all regions saw positive growth compared to December, with the Midwest seeing the greatest gains and the West the least.

Rents continue to skyrocket in San Francisco

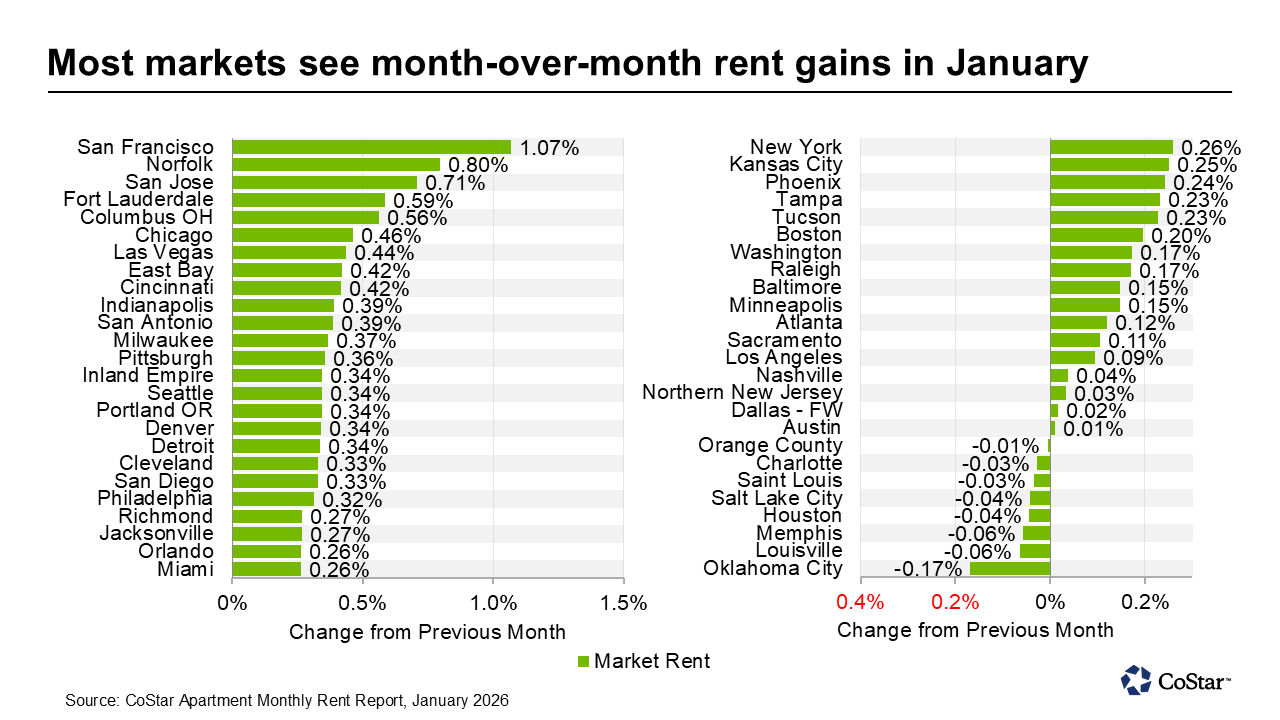

Monthly rent growth was positive for 42 of the top 50 markets, with the declining rents found mostly in the oversupplied Sun Belt and Mountain West. Oklahoma City saw the greatest decline since December, with rents falling by nearly 0.2 percent.

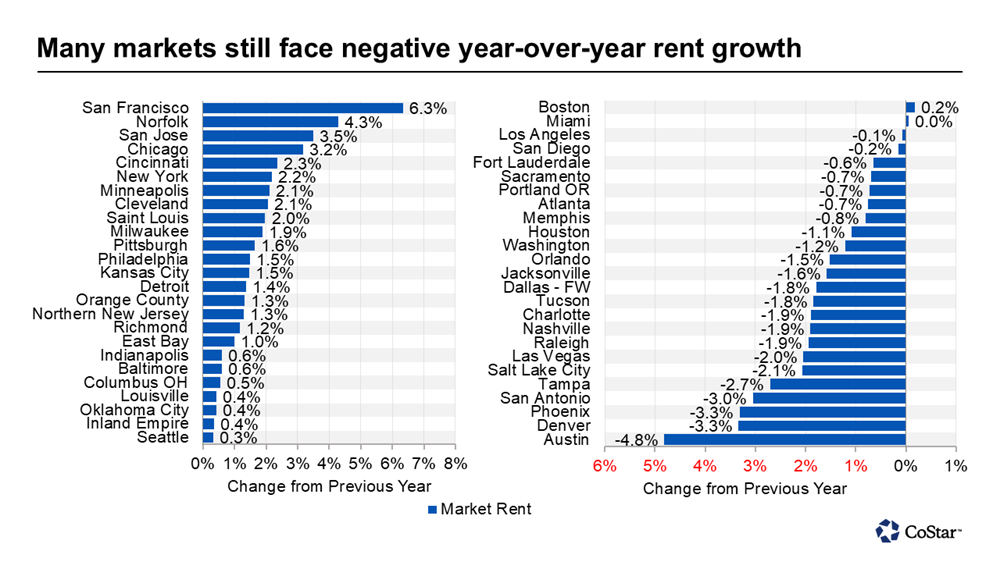

In terms of annual growth, San Francisco kept its spot at the top of the chart, with rent growth of 6.3 percent far outpacing Norfolk, Virginia, the runner-up at 4.3 percent, and San Jose, California, in third place with 3.5 percent.

The same three markets also took the top spots for monthly rent growth.

These markets have benefited from limited development and healthy demand supported by relatively strong local employment.

The supply wave, which crested in 2024 and has been declining since, continues to weigh on multifamily performance nationwide, with the markets with the highest levels of recent construction struggling the most. Weakening employment and slowing demand have also contributed to underperformance.

Only a few years ago, the Austin multifamily market had one of the most active development pipelines in the country. In the first quarter of 2023, under-construction units made up 20 percent of Austin’s total inventory. Although the pipeline has slowed since, Austin has continued to struggle to absorb its excess inventory. The market remains at the bottom of the chart, with rent declining in Austin by 4.8 percent year over year.

Joining Austin in the bottom five spots are Denver (negative 3.3 percent), Phoenix (negative 3.3 percent), San Antonio (negative 3 percent), Tampa (negative 2.7 percent), and Salt Lake City (negative 2.1 percent).

Explore more multifamily insights

Where is the multifamily market headed in 2026? Get the outlook, along with the highlights of 2025, in a recent webinar with CoStar analyst Grant Montgomery, available on demand.

Watch now: