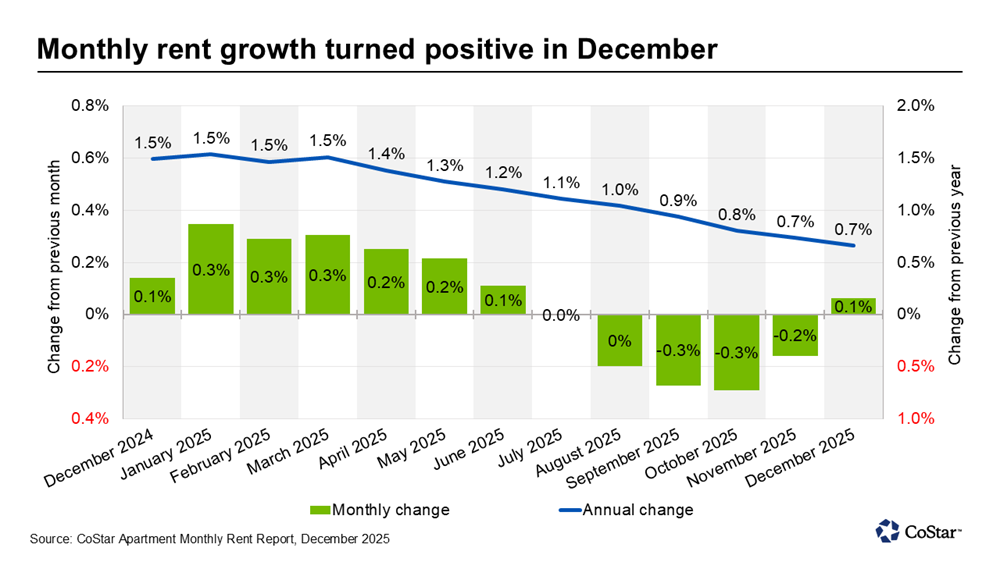

After five months of flat or declining rents month over month, December offered a positive shift, according to the latest CoStar report. Asking rents rose by 0.1 percent from November to December. The multifamily market closed the year with annual rent growth at 0.7 percent nationally.

Rent growth decelerates over the year

Over the course of 2025, rent growth decelerated gradually, as the market struggled with the overhang of new supply paired with insufficient demand. The year began with annual rent growth at 1.5 percent, where it remained for the first quarter and then began to slow. By August rent growth had fallen to 1 percent, and it closed the year at 0.7 percent.

While December’s modest month-over-month increase was insufficient to accelerate national rent growth, it helped pause the downward slide that characterized most of the year. Annual rent growth fell from 0.8 percent in October to 0.7 percent in November but remained steady at 0.7 percent through December.

Midwest and Northeast continue to outperform

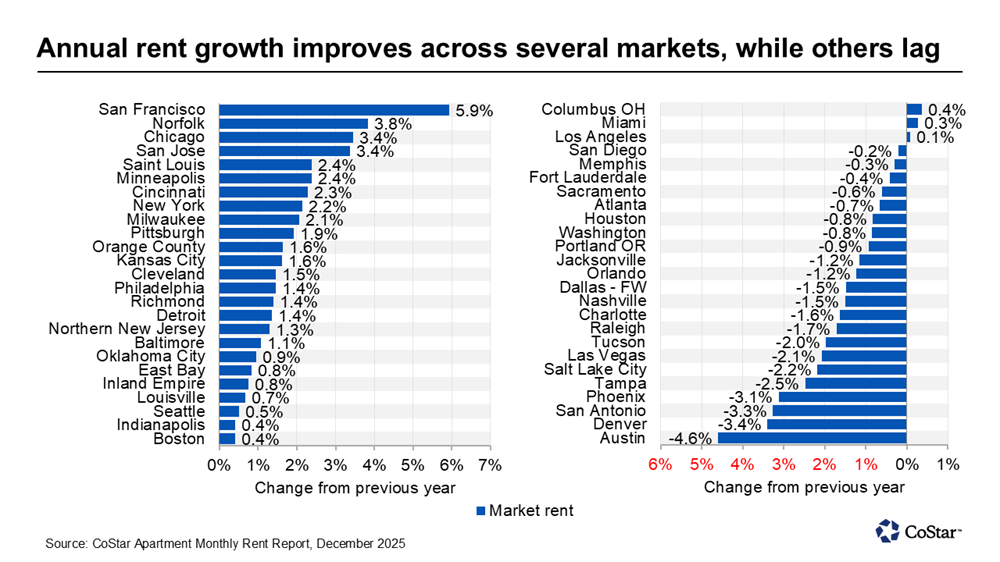

At the regional level, the two rent growth leaders of 2025 retained their edge. The Midwest closed the year with 2.2 percent annual rent growth — over three times the national average — and the Northeast took second place with 1.5 percent, over twice the national average.

The Midwest and Northeast represented most of the top-performing major markets on the rent growth charts. The top 10 markets for annual rent growth included Chicago (3.4 percent), St. Louis (2.4 percent), Minneapolis (2.4 percent), Cincinnati (2.3 percent), New York (2.2 percent), Milwaukee (2.1 percent), and Pittsburgh (1.9 percent).

California presented a notable challenge to these regional trends, with a number of major markets that outperformed the nation. San Francisco retained its top spot in the rent growth charts, closing the year with 5.9 percent rent growth. Nearby San Jose took the fourth spot with rent growth of 3.4 percent, and Southern California’s Orange County market ranked 11th with 1.6 percent rent growth.

Virginia’s Norfolk market also showed a strong performance, rising to the second spot in the annual rent growth charts with 3.8 percent, thanks to strong renter demand paired with limited new development.

Rents decline in the South and West

While the Midwest and Northeast have benefited from limited new development, contributing to a healthy balance between supply and demand, oversupplied markets in the South and West have kept these regions in negative territory, with demand eclipsed by supply.

The South ended the year with annual rent growth of negative 0.1 percent, while rents in the West fell by 1.4 percent.

All of the 10 lowest performing markets for rent growth were in the South or West. Austin remained at the bottom of the list, with negative 4.6 percent rent growth. It was joined by Denver (negative 3.4 percent), San Antonio (negative 3.3 percent), Phoenix (negative 3.1 percent), Tampa (negative 2.5 percent), Salt Lake City (negative 2.2 percent), Las Vegas (negative 2.1 percent), Tucson (negative 2 percent), Raleigh (negative 1.7 percent), and Charlotte (negative 1.6 percent).

These markets, where supply has outstripped demand, also faced double-digit vacancy rates as of the end of the year.

Explore more multifamily insights

Where is the multifamily market headed in 2026? Get the outlook, along with the highlights of 2025, in an upcoming webinar with CoStar analyst Grant Montgomery.