Download our free Adverse Action Letter Template

Checking an applicant’s credit is an important part of the tenant screening process. A rental credit check gives you insight on an applicant’s spending habits and whether they pay their debts, which is a good indicator of whether they will pay their rent on time every month.

Before you start screening your next applicant, let’s go over everything you need to know about rental credit checks.

Why Do Credit Checks Matter?

A credit check is the part of the tenant screening process when you review an applicant’s credit report. The credit report will show you an applicant’s credit score, payment history, open lines of credit, and any bankruptcies or collections.

One bad tenant can seriously impact your cash flow, and a rental credit check can be your first line of defense. Identifying red flags like consistent late payments can help you avoid problematic renters.

How do I do a credit check on a potential tenant?

There are two ways you can do a credit check: through a credit bureau or through another online platform. The three credit bureaus—Experian, Equifax, and TransUnion—all offer credit screening at a fee.

Another option is to screen tenants through Apartments.com. When you accept applications and screen tenants through Apartments.com, you’ll receive a comprehensive screening report from TransUnion. This includes a full credit report run as a soft inquiry, so it won’t negatively affect the applicant’s credit.

What to Look for in a Tenant’s Credit Report

After you’ve received an application for your rental, it’s time to run a background check and a credit check. Here are four key things to look at when you receive the credit report.

Credit score

Credit scores are a numeric summary of a credit report calculated on a scale from 300 to 850, with 850 being the best possible score.

While lenders and credit bureaus often have different definitions of a “good” credit score, credit scores are typically broken down into the following ranges:

- 800+ = Exceptional

- 740-799 = Very good

- 670-739 = Good

- 580-669 = Fair

- 300-579 = Poor

Each credit bureau uses a different algorithm to calculate credit scores, but they all consider payment history, credit utilization, credit mix, credit age, credit applications, and negative marks like collections or bankruptcy. A good credit score shows that an applicant routinely pays bills on time and has good financial habits that would make them a trustworthy tenant.

A potential tenant’s bad credit score doesn’t have to disqualify them from renting. Rather than immediately declining their application, consider charging a higher security deposit, requesting references, or asking the applicant to add a cosigner or guarantor to the lease. These extra steps help you further vet an applicant and provide a financial safety net in case they fail to pay rent.

Payment history

An applicant’s payment history is one of the most important aspects of a credit check. If a tenant doesn’t make their credit payments on time, they might be a risky tenant who doesn’t pay rent on time. While a single late payment shouldn’t cause too much concern, consistent late or missed payments are a red flag.

Credit utilization

Credit utilization is the ratio of overall used credit to the amount of available credit. A low credit utilization ratio is a sign of responsible financial management; an applicant with a low credit utilization ratio pays off debt and doesn’t max out credit cards. The Consumer Financial Protection Bureau recommends keeping credit utilization under 30%.

Credit utilization is calculated by dividing total debt by total available credit. Here’s an example comparing two rental applicants, both with a single credit card:

Applicant A has a credit card with a $20,000 limit. They currently have a balance of $4,000.

$4,000/$20,000=0.20 or 20%

Applicant A’s credit utilization rate is in the healthy range. This renter probably manages debt responsibly and doesn’t bite off more than they can chew.

Applicant B has a credit card with a $10,000 limit. They also have a balance of $4,000.

$4,000/$10,000=.40 or 40%

Applicant B’s credit utilization ratio is too high. They may not be financially literate, or they might struggle to pay off debts.

Credit utilization can give you a sneak peek into an applicant’s daily financial habits, but it should be reviewed in conjunction with the rest of the credit report to get the full story.

Staying Compliant

There are two federal laws that protect renters in the apartment hunting and application process: the Fair Housing Act and the Fair Credit Reporting Act.

Fair Housing Act

The Fair Housing Act (FHA) protects renters from discrimination based on race or color, religion, sex, national origin, familial status, and disability. This means that you can’t deny a renter’s application, impose discriminatory lease terms, or limit a renter’s rental choices based on these protected characteristics. Some states extend FHA protections to other characteristics, so check your state laws.

To stay compliant with FHA in the tenant screening process, make sure your decisions are based on objective screening criteria. Things like employment status, eviction history, and credit score are all objective information directly related to a renter’s ability to be a good tenant.

Fair Credit Reporting Act

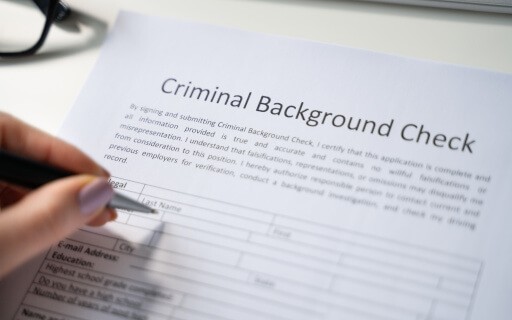

Under the Fair Credit Reporting Act (FRCA), individuals are entitled to know if anything in their credit report is being considered against them, and they’re entitled to dispute inaccuracies in their report. If you’re considering denying a renter’s application based on something in their credit report, you must send an adverse action notice.

An adverse action letter tells a renter that you’re declining their application, lists specific reasons why you’re declining their application, and informs them of their rights under the FRCA. This notice allows renters to dispute inaccuracies on their credit report with the credit bureau or negotiate with you for a higher security deposit or cosigner.

An adverse action letter should look something like the following:

[Property Address]

[City, State, Zip]

[Today’s Date]

Dear [Name of Applicant],

Thank you for applying to [Property Address]. Unfortunately, we are currently unable to accept your application due to the following reason(s):

- Credit score does not meet minimum

- Unable to verify income

- Excessive debt compared to income

- Irregular employment

- Insufficient credit history

If your application has been rejected due to insufficient credit, you have the right under the Fair Credit Reporting Act to request a free credit report through [Screening Service Used] or to dispute inaccuracies.

To dispute or appeal this decision, please contact [Your Full Name] by email at [Your Email], by phone at [Your Phone Number], or by sending a written letter to [Your Address] within [Number] days of receiving this notice. Should you have any further questions regarding the contents of this letter, please do not hesitate to reach out.

Sincerely,

[Your Signature]

[Your Full Name]

Download our free Adverse Action Letter Template to get started.

This article was originally published on May 10, 2021, by Megan Bullock and has been updated.

FAQs

Can a tenant provide a copy of their own credit report?

While it’s possible for a tenant to provide their own credit report, especially if they’re applying to more than one property and have pulled it in the last 30 days, it’s typically in your best interest as the landlord to run your own credit check. There may be regulations in your area about whether you can accept a report from the applicant, so be sure to check your state laws before doing so.

Are credit checks hard or soft pulls?

Credit check can be either hard or soft pulls, but most are soft pulls. Keep in mind that a soft pull will not impact an applicant’s credit score, but a hard pull will. Because of this, most landlords choose a soft pull. If you choose a hard pull, you should get permission from applicants to do so.

When you screen a tenant through Apartments.com, TransUnion’s credit report will be a soft pull.

How do I handle applicants with bad credit?

Applicants with bad credit don’t have to be immediately disqualified from renting, but you should approach them differently. If you choose to be flexible with your credit policy, you can mitigate risk in other ways, like requiring a larger security deposit, a cosigner, or first and last month’s rent up front.

When should I require a cosigner?

Requiring a cosigner is often on a case-by-case basis, so it’s up to you when to do so. If requiring a cosigner helps you mitigate the risk of a tenant with bad credit, then it might be a good idea. Make sure that if you do require a cosigner, you run a background and credit check on them as well.

Does a credit check replace paystubs and W2 records?

Running a credit check does not replace pay stubs or W2 records. Pay stubs and W2 records can be used as proof of income during the tenant screening process, supplementing the information in a credit report.

Can I decline a rental application based on an applicant’s credit score?

Yes, you can decline a rental application based on an applicant’s credit score. However, you are required by federal law to send an adverse action letter that informs them that something in their credit report is being considered against them.