The deceleration of national rent growth continued in July, according to the latest CoStar data. Annual rent growth, which had hovered in the low 1 percent range since mid-2023, came in at 1.1 percent. Average asking rents saw no month-over-month change, holding steady at $1,717.

Midwest markets continue to outperform

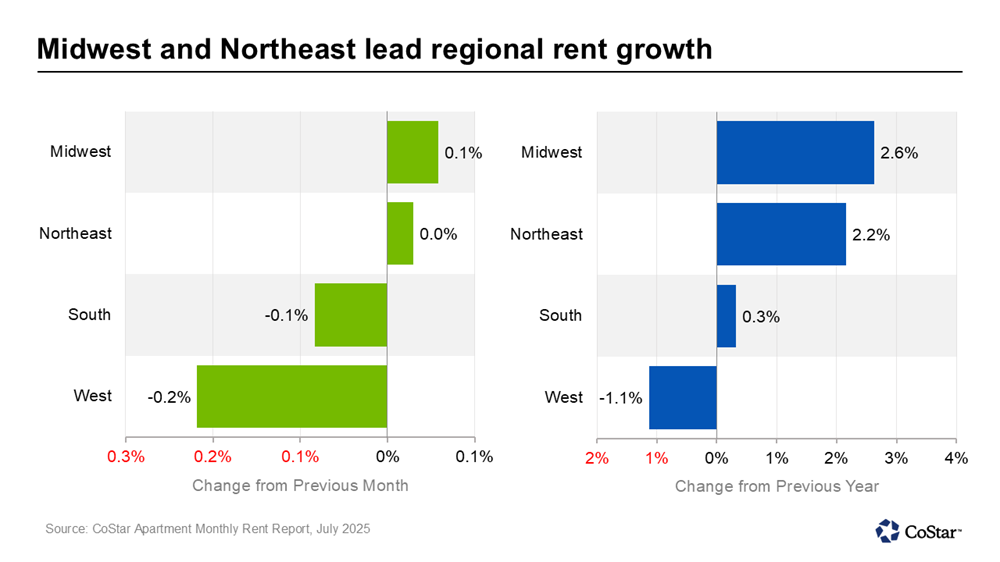

At the regional level, the Midwest region remains strong. The Midwest posted year-over-year rent growth of 2.6 percent, well over twice the national average. In second place, the Northeast saw rents increase by 2.2 percent, double the national average.

At the other end of the scale, the South and West regions underperformed the rest of the country.

The South, where asking rents barely budged, posted a year-over-year increase of 0.3 percent. This region has seen a high volume of new deliveries and has faced higher than average vacancy rates.

Performance in the West was mixed. The region is home to rent growth leaders and laggards alike, with some major markets from the West appearing on the top 10 list for rent growth and others among the bottom 10. Overall, the West region saw asking rents decline by 1.1 percent year over year.

Bay Area markets maintain rent growth lead

While Midwest and Northeast markets comprised most of the top 10 list, two Northern California markets took top spots in the latest rent growth rankings.

San Francisco, which crept into the #1 spot this year, posted rent growth of 5.3 percent — nearly five times the national average. The San Jose market, which neighbors San Francisco, took the third spot with 3.2 percent rent growth.

Chicago came in second with 3.8 percent rent growth. Rounding out the top 10 were Norfolk, Virginia (2.7 percent), Pittsburgh (2.7 percent), Cincinnati (2.6 percent), New York (2.5 percent), Kansas City (2.4 percent), Detroit (2.3 percent), and Minneapolis (2.3 percent).

Rents in Austin keep falling

The markets with the greatest year-over-year declines were all in the South and West.

Rent declines were the steepest in Austin, where oversupply challenges have kept vacancy high. Austin fell to the bottom of the rent growth charts in late 2023, where it has remained ever since. In July, rents in Austin decreased by 4.3 percent.

Other markets with significant declines include Denver (-3.5 percent), Phoenix (-2.9 percent), San Antonio (-2.3 percent), Tucson (-1.8 percent), Dallas-Fort Worth (-1.4 percent), Las Vegas (-1.4 percent), Salt Lake City (-1.3 percent), Orlando (-1.2 percent), and Raleigh (-1.1 percent).

Explore multifamily insights

Where does the multifamily market stand as of mid-2025? Join CoStar’s Connor Devereux for the latest analysis of multifamily trends. Watch now: