National multifamily rent growth remains weak at the national level, according to the latest CoStar data. As of August 2025, year-over-year asking rent growth came in at 1 percent nationwide. Rent growth has hovered around the 1 percent mark since late 2023, well below the double-digit gains seen during the pandemic-era peak.

This plateau in rent growth reflects a continued softening in the market. At the same time, the national multifamily vacancy rate has remained around 8 percent for nearly two years.

Regional trends reveal stark divide

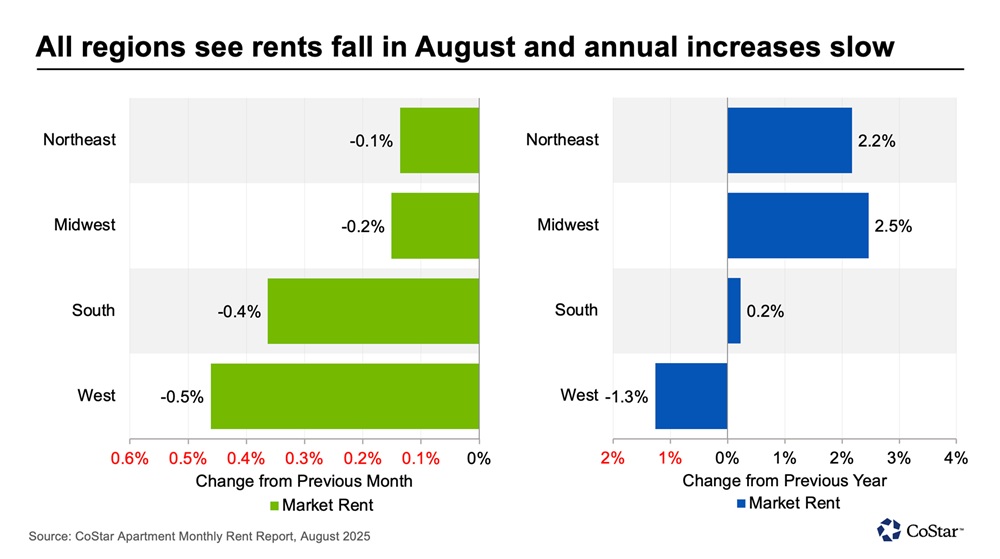

When rent growth is broken out at the regional level, clear winners and losers emerge. The Midwest and Northeast, which have outperformed the nation since 2023, continue to pull ahead. The Midwest posted annual rent growth of 2.5 percent in August, while the Northeast saw rents rise by 2.2 percent.

In contrast, rents in the West fell by 1.3 percent year over year. And at 0.2 percent, rent growth in the South was again barely above zero.

All four regions saw a month-over-month decline in rent growth, which reflects typical seasonal softening as renter demand declines in late summer and fall.

San Francisco and Chicago remain rent growth leaders

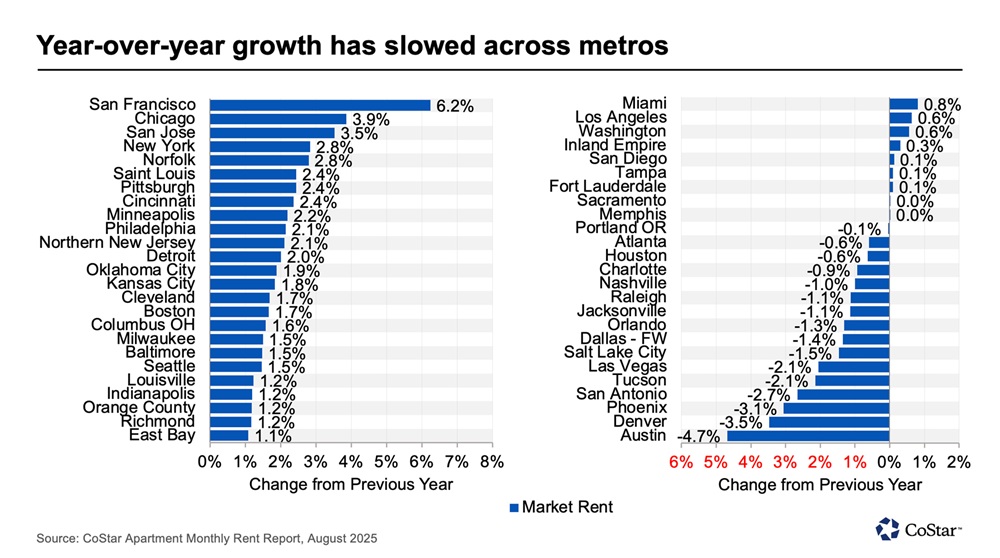

At the metro level, San Francisco, Chicago, and San Jose retain the top three spots they held in July. As of August, these markets posted year-over-year rent growth of 6.2 percent, 3.9 percent, and 3.5 percent, respectively, followed by New York at 2.8 percent.

New supply remains limited in these high-performing markets. Paired with strong renter demand, these metros have seen asking rents increase by three to six times the national average.

At the other end of the scale, Austin continues to post rent declines of over 4 percent. The oversupplied Texas capital and surrounding area saw rents drop by 4.7 percent since August last year. With rents falling by 3.5 and 3.1 percent, respectively, Denver and Phoenix rounded out the bottom three markets.

These rankings reflect broader supply trends in the post-pandemic period. Markets that have maintained limited construction, such as those in the Midwest and Northeast, as well as California, are outperforming the national average.

On the other hand, markets where development has boomed, such as many Sun Belt metros, renter demand has been insufficient to absorb the flood of new construction. As a result, these markets have seen double-digit vacancy rates and negative or flat rent growth.

Explore more multifamily insights

Where does the multifamily market stand as of mid-2025?

Join CoStar’s Connor Devereux for the latest analysis of multifamily trends. Watch now: