Football fans know it’s not just a game. From tailgates to touchdowns, football is a cultural phenomenon that can ripple through communities in unexpected ways.

In cities across the United States, the success of college and professional football teams has proven to be a powerful economic driver, influencing everything from local pride to the economy. From Athens, Georgia, to San Francisco, California, the connection between football victories and rising rents is undeniable.

Here are 10 cities where the gridiron glory of football has left its mark on rental costs.

Kansas City, MO

Kansas City is an up-and-coming Midwestern powerhouse economically, and the Chiefs’ success has played a role in putting the city on the map. With the Rams leaving St. Louis in 2016 to return to Los Angeles, the state’s pro football hopes have been laser-focused on Kansas City. Missouri football fans haven’t been disappointed; the Kansas City Chiefs have made it to the pro playoffs for the last 10 seasons, competing in the championship for five of those seasons.

In addition to KC’s pro football prowess, “Swiftonomics” come into play. In the summer of 2023, rumors began circulating that the Chiefs’ star tight end Travis Kelce had begun dating everybody’s favorite showgirl, Taylor Swift. They went public in September 2023, when Swift attended her first Chiefs game at Arrowhead Stadium, and the Chiefs went on to win their second consecutive championship title for the 2023 season.

Kansas City’s current rent is about 5% higher since Swift and Kelce began dating, and demand has remained hot despite an influx of new deliveries in 2023 and 2024. Lease-ups in Kansas City spiked to new heights after the Chiefs’ 2020 championship win, and they spiked again after the 2023 championship that Swift attended.

With a population increase of about 8,000 between 2020 and 2024 and a rental market that’s hotter than ever, the message is clear: Taylor Swift and football are good for Kansas City’s economy.

Los Angeles, CA

The Los Angeles Rams had a successful run in the 2020 and 2021 seasons. In 2020, they finished the regular season with a 10-6 record and made it to the playoffs via Wild Card. While they lost the divisional playoffs to the Green Bay Packers, they finished sixth in the NFC conference.

The Rams’ 2021 season was much more exciting, with a 12-5 regular season record and an pro football championship win at the Rams’ home stadium, SoFi Stadium. It was also the first football season that SoFi Stadium was open to fans, spurring excitement around post-pandemic events.

The Los Angeles area saw significant rent growth in 2021 and 2022 after the Rams’ successful seasons. Rent increased by 4.8% throughout 2021, the vacancy rate fell from 5.7% to 4.1%, and the city saw record lease-ups between April and September. In 2022, rent increased by 1.6%, and the vacancy rate rose to 4.6% by the end of the year as deliveries outpaced lease-ups.

Miami, FL

In 2020, Miami hosted the pro football championship at Hard Rock Stadium between the San Francisco 49ers and the Kansas City Chiefs. After that, the city’s vacancy rate took a nosedive and lease-ups saw record highs. Miami’s average rent increased by 3.2% in the 12 months following the game, increasing from $1,948 per month to $2,010 per month.

While hosting the 2020 championship brought some attention to the city, most of the demand shift can be attributed to international migration from Cuba. Metro areas across the U.S. saw domestic migration as people adapted to remote work, but Miami’s population growth came from Cuban immigrants fleeing their home country.

In July of 2021, Cuban citizens sparked protests across the island triggered by a shortage of food and medicine and anger over the government’s response to the COVID-19 pandemic. Over 850,000 Cubans emigrated to the U.S. between 2021 and 2024, and Miami-Dade County is a common landing pad for Cuban refugees. Miami’s average rent increased by 9.1% in the 12 months following the July 2021 protests, from $2,152 per month to $2,347 per month.

San Francisco, CA

The San Francisco 49ers made it to the pro football championship in 2020 and 2024, losing to Kansas City both times. 2020 was the first time the 49ers had made it to the playoffs since 2014, and 2024 marked the third consecutive year of playoff appearances.

While rent decreased and vacancy rates increased following the 2020 championship, this trend was heavily influenced by new deliveries and the COVID-19 pandemic disrupting the market. The rental market saw much stronger outcomes after the 2024 championship, with a 3.4% increase in average rent and a 1.1 percentage point decrease in vacancy in the 12 months following the championship.

While the excitement around the 49ers’ successes has likely fostered a stronger community that attracts newcomers, a main driver of the demand for rentals in San Francisco is the AI boom. According to Brookings, San Francisco job postings with AI skills more than doubled between 2024 and 2025, and tech companies are popping up all over the city. This gold rush made San Francisco one of the hottest markets in 2025.

Tampa, FL

Tampa saw a drastic 17.8% increase in the city’s average rent—from $1,531 per month to $1,803 per month—after hosting the 2021 pro football championship that the Tampa Bay Buccaneers won, with record high lease-ups in the few months after the championship. The city’s vacancy rate dipped throughout 2021 before rising again in 2022 amidst new units entering the market.

The spotlight was on Tampa all of 2021. In addition to hosting the championship and the Buccaneers’ win, Tampa claimed several accolades from various publications. Forbes named it the top emerging tech city in the U.S., and it was one of the top metro areas for job growth in the tech industry.

Athens, GA

After winning the first championship title in 41 years during the 2021 season, the University of Georgia received about 4,000 more freshman applications than the previous year, an increase of over 10%. Freshman enrollment also climbed from 5,850 in fall 2021 to 6,200 in fall 2023 after UGA’s back-to-back wins.

With higher enrollment came higher rents. The average rent in Athens in 2021 was $1,236 per month. After winning the championship title for the 2021 season, the annual rent average rose to $1,336 per month in 2022, an 8% increase. After the second win in a row in the 2022 season, the annual rent average increased another 3% to $1,374 per month in 2023.

Clemson, SC

Like Athens, Clemson’s rental market is heavily influenced by college football. Clemson has made it to the championship four times; they took home trophies for the 1981, 2016, and 2018 seasons and finished the season as runner-up in 2019.

After Clemson’s back-to-back championship appearances for the 2018 and 2019 seasons, applications for the fall 2021 term skyrocketed to a 64.4% increase over applications for the fall 2020 term. While the school’s athletic success likely played a role in attracting more students, Clemson adopted a test-optional policy in 2020 that made the application process more accessible. This was initially in response to the COVID-19 pandemic disrupting high schoolers’ standardized testing opportunities, but the university has kept the policy in place ever since.

Clemson’s freshman enrollment for fall 2021 was 9.4% higher than freshman enrollment for fall 2020. Clemson’s total undergraduate enrollment was 3.8% higher in fall 2021 than the year before.

With more applications and admissions came a higher population, and the Clemson area saw a huge rent increase in 2021. Clemson’s average rent was $908 per month at the beginning of 2021 and finished the year at $960 per month, a 5.7% increase over the course of 12 months. With no new units entering the market in 2021, the Clemson rental market prepared for a surge in demand due to a rapidly increasing student population.

Columbus, OH

After Ryan Day became head football coach in 2019, the Ohio State Buckeyes went undefeated in the regular season and advanced to the playoffs before losing to Clemson in the semifinals.

Ohioans clearly felt confident in the Buckeyes’ new coach; OSO saw record freshman enrollment in the fall of 2020, and enrollment among in-state students increased by 1.7% between the 2019 and 2020 academic years. Like Clemson, Columbus saw drastic rent hikes as the area braced for the record-breaking freshman class to move off campus. Despite several years of steady deliveries, Columbus saw a 5.8% rent increase between fall 2020 and fall 2021, with the average rent increasing from $1,134 per month to $1,200 per month.

Oxford, MS

Oxford is the home of the University of Mississippi, more commonly called Ole Miss. Oxford has seen rent surges over the past year that can be attributed to Ole Miss enrollment. Between 2021 and 2024, the Oxford campus’ student body increased by 27.3% from 18,800 to almost 21,000.

Like many other universities with major college football programs, Ole Miss’ applications and enrollment are highly correlated with their football team’s performance. Ole Miss made it to the college football semifinals for the 2025 season before losing to the University of Miami. This was Ole Miss’ first playoff appearance, a milestone for the program despite the loss. Rent in Oxford is already increasing, with the current one-bedroom rent of $1,356 per month averaging 7.1% higher than last year.

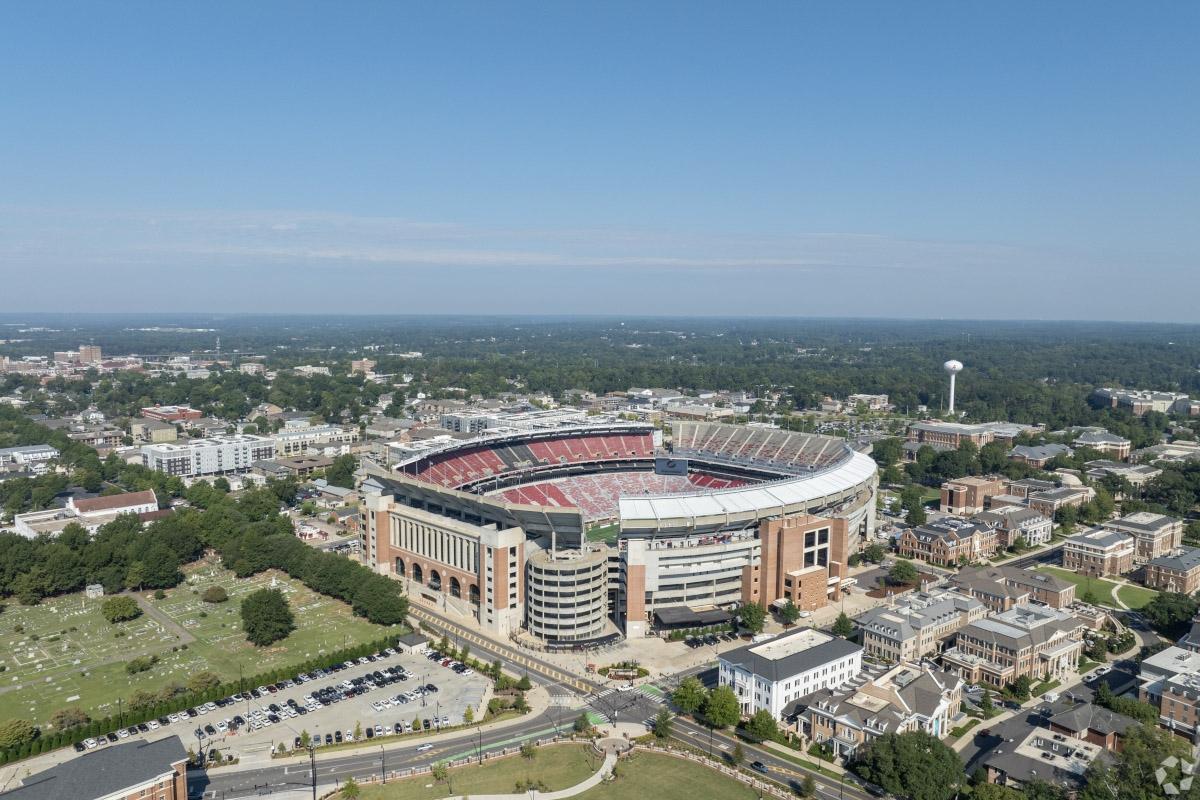

Tuscaloosa, AL

After their back-to-back championship appearances in the 2020 and 2021 seasons, the University of Alabama saw over 11,500 more first-year applications for the fall 2022 semester than the year prior, an increase of about 27.5%. Admissions and enrollment increased proportionally, with freshman class sizes increasing from 6,507 for the fall 2020 term to 8,037 for the fall 2022 term.

With more students in the Tuscaloosa area, the annual average rent rose from $903 per month in 2021 to $986 per month in 2022, a year-over-year increase of 9.3%. Rent continues to rise as increased class sizes create higher demand.

From college towns to major cities, football’s influence extends far beyond the endzone. Championship wins and playoff runs bring more students, fans, and newcomers, driving up rents and reshaping local economies. As the sport continues to captivate millions, its impact on housing markets is a trend worth watching.

Rent, vacancy, and construction data are provided by CoStar Group’s Multifamily Market Reports as of January 2026.