Inflation, the climbing costs of goods and services, can drive rent prices higher. Depending on where you live in the US, you’ll experience different effects of inflation. Find out about the impact of inflation on rent prices and how you can deal with rising rent.

Key Takeaways

- Rent prices rose sharply alongside inflation during the COVID era, with average U.S. rents climbing from $1,493 in late 2020 to $1,706 by mid-2022 — mirroring a CPI increase from 261 to 292 during the same period.

- Urban and high-demand areas feel inflation’s effects more acutely, where even modest CPI increases can lead to significant rent hikes. In contrast, rural areas with more housing availability often see more stable rents.

- In the Sun Belt, rent prices are stabilizing or dropping, as high levels of new construction outpace renter demand, leading landlords to offer concessions and lower rents to fill vacancies.

Why Is Rent on the Rise?

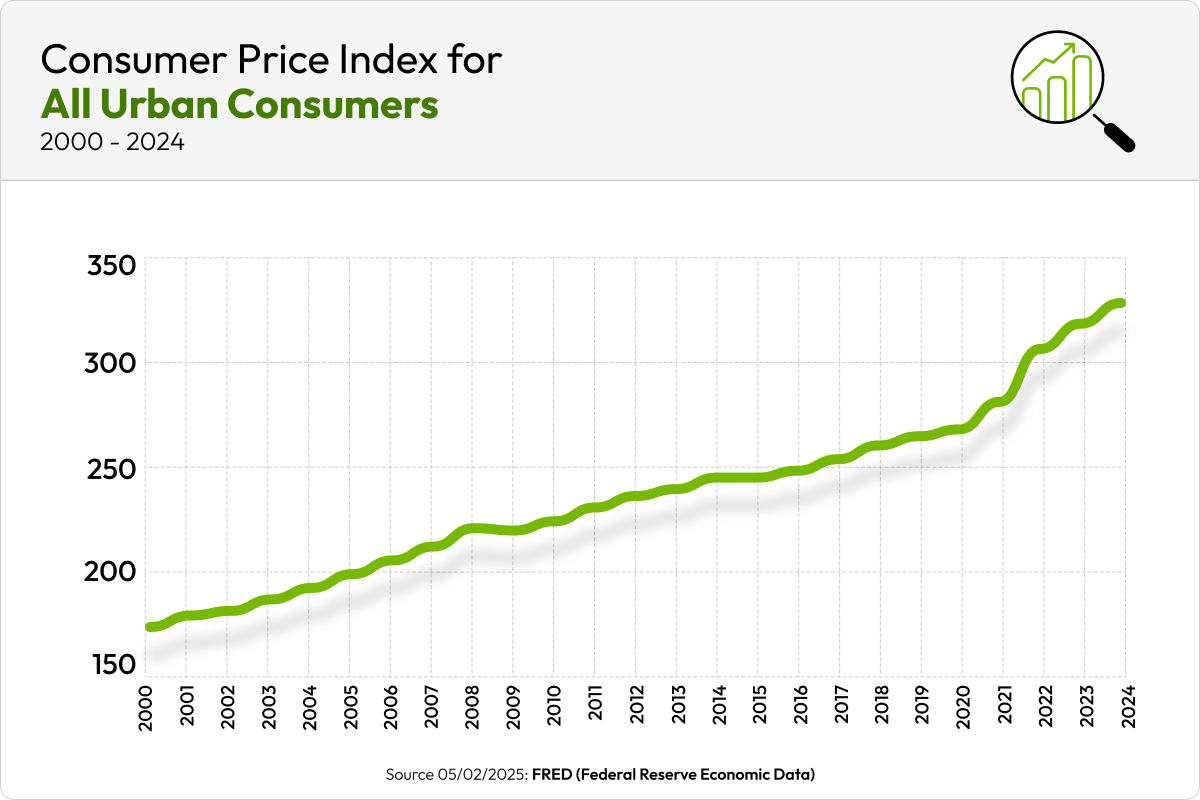

Inflation is a rise in the average cost of goods and services measured in monetary terms. Typically, it is measured using the consumer price index (CPI), which reflects how much more expensive goods and services have become. It is a reflection and driver of economic conditions.

Just as inflation affects the economy, it also affects rent prices. As the costs of owning, operating, maintaining rentals, and property management rise, landlords face higher expenses. From utilities and insurance to maintenance and repairs, everything becomes more expensive. To manage this increasing cost, landlords charge higher rent prices.

How Inflation Drives Rent Increases

Supply and demand have an impact on rent prices. There needs to be a delicate balance between the two, which is often disturbed by an influx of new construction or people moving to the city.

When demand exceeds supply, prices increase and create a lot of competition among renters for what is available. New York is an excellent example of where this happens. The rent there is so high because the demand grows as the population increases.

This can happen in smaller cities, too. As renters flock to them because of a low cost of living or job opportunities, the demand increases. However, the city may not have a lot of new construction, leading to a shortage that raises rent.

On the flip side, if there is low demand but a lot of apartments are being built, then you could find low rent prices. To fill vacancies, landlords sometimes lower rent and offering rent concessions and move-in specials. Currently, this is seen in the Sun Belt, where there is ample supply but not much demand. Maintaining a good balance of supply and demand is hard, but it is the key to reasonable rent prices in a city.

The Impact of Inflation on Renters

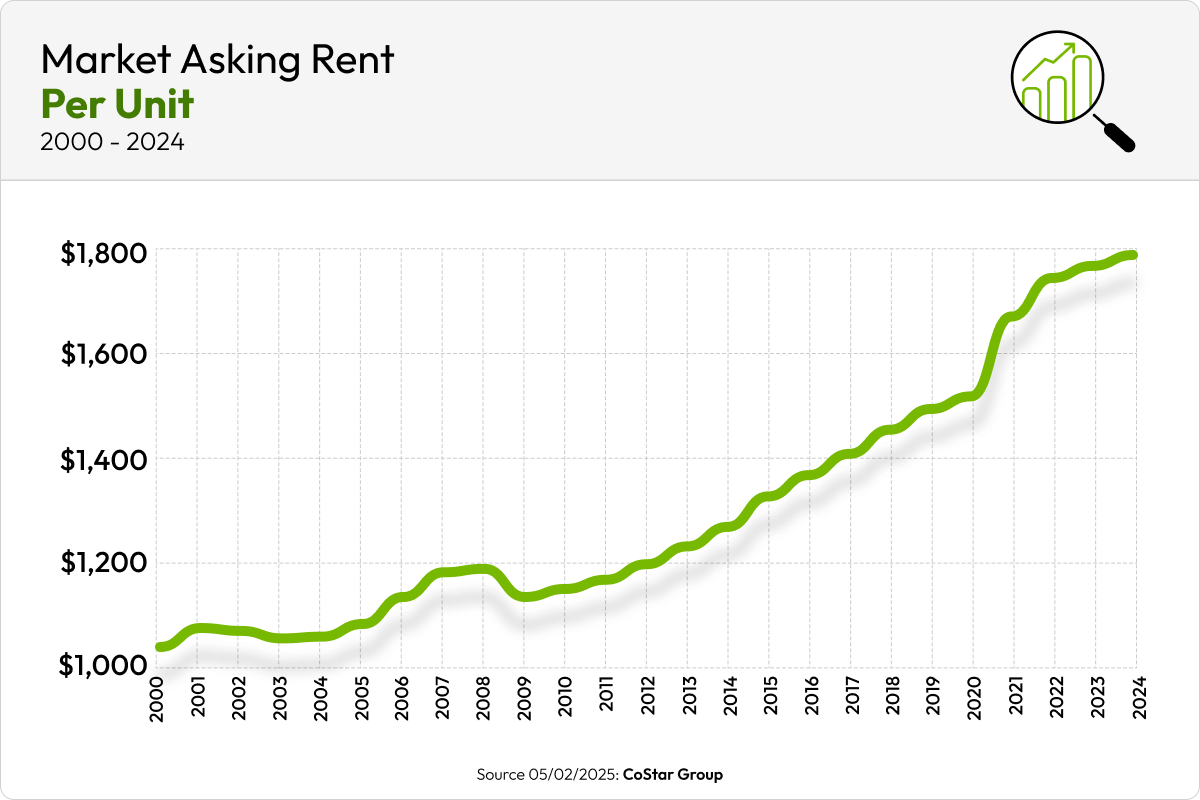

To examine the impact of inflation on renters, it is best to look at the CPI and the average market asking rent for a unit. Overall, you’ll see that the two lines are quite similar; when there’s a bump in inflation, rent follows suit.

The CPI is often measured using a scale where the average prices from 1982–1984 are set as 100. Any number above 100 shows that prices have increased since that time, meaning inflation has occurred. For example, if the index is 300, it means that prices are three times higher than they were during the 1982–1984 period.

A noticeable occurrence was in 2008, when inflation sharply rose before dropping back down. At its peak in 2008 Q3, the index was at 219 before it fell to 212 in 2009 Q1. Rent followed the same peak and fall, but a bit slower. The average rent was $1,201 in 2008 Q3 at the peak, and it fell to a low of $1,142 in 2010 Q1.

From 2020 to 2022, everything skyrocketed because of COVID. Inflation steeply climbed from 261 in 2020 Q4 to 292 in Q2. That was a nine percent change compared to a year prior. Rent prices rose from $1,493 in 2020 Q4 to $1,706 in 2022 Q2. It leveled out after that at a more typical growth rate.

Regional Variations: How Inflation Affects Rent Across the US

Depending on your region, the correlation between inflation and rent can differ. In areas with high housing demand and limited supply, rent prices may rise faster than inflation. Conversely, rent increases may lag behind inflation in regions with declining populations or excess housing.

Rent increase in high-demand areas

Urban areas and hot rental markets have more demand, so more rent is charged, which can be exacerbated by inflation. Even a small increase in inflation can significantly impact rent prices.

Rural vs. urban rent impact

In rural areas, where there is less demand, the prices may not be affected as much, even with a rise in inflation. The higher availability of apartments can help buffer these regions from being hit hard by inflation.

How to Manage Rising Rent

No one likes it when their rent goes up, but it happens. When faced with that situation, you can try a couple of approaches.

The first approach is negotiating rent. Check if your landlord is willing to do so before you start anything. Then do your research. See what comparable prices are in the area and other properties/units your landlord owns. Bring that research to the negotiation, along with proof that you’re a good tenant. The landlord might concede to a lower rent, rather than trying to find someone new.

While your landlord might not be willing to negotiate your rent, you can ask for a rent concession or move-in special. Even if you’re renewing, you can ask your landlord for a small concession, like a free carpet cleaning.

Another way to lock in a low rent price is by signing a long-term lease. Landlords often offer lower rents on longer lease terms to incentivize you to stay. You’ll keep the same rent for the entirety of your lease, even if inflation rises.

If you love where you live but rent is increasing, you could get a roommate. A roommate will split the rent with you, making rent more affordable for both of you.

However, if all else fails, it might be time to move instead of renewing. You’ll have to deal with moving costs and new apartment fees, such as a security deposit and application fee, but it could be worth it if you find a lower rent rate.

Will Rent Prices Keep Rising?

Rent prices depend on a lot of factors, from inflation to supply and demand. While it would be nice if there were a crystal ball that could tell us the future of rent prices, there isn’t. The best way to know is by being informed.

Knowing the different elements that cause rent increases and the economy's general health can help you predict what will happen to rent prices. Keeping up with multifamily market news is an easy way to get the latest happenings and predictions. CoStar reports that the demand for apartments is increasing, but new construction is slowing. So, rent prices very well could increase.

Methodology

All rent-related data, including current and historical rent trends, is sourced from CoStar Group, a leading provider of real estate data and analytics. The Consumer Price Index (CPI), which measures inflation and changes in purchasing power, is obtained from FRED (Federal Reserve Economic Data), a trusted resource maintained by the Federal Reserve Bank of St. Louis.

See Rent Trends on Apartments.com

Apartments.com compiles rental market trends for most cities in the US. You can see the average rent and how much it has decreased or increased compared to the same time last year. See which states have seen the largest rent increases and the ones with the lowest rents.

FAQs

Does rent go down in a recession?

Rent prices usually drop during a recession because of a lack of demand. People are not moving or want something more affordable, so rent prices fall to match that. However, there are cases where it has remained stable or increased because of a limited supply, a strong job market, or another influencing factor.

Can inflation lead to a decrease in rent prices?

In certain scenarios, inflation can lead to a decrease in rent prices because of reduced demand, new construction, or another reason. More commonly, inflation causes an increase in rent prices as landlords face rising costs.

How do rent control laws interact with inflation?

Rent control laws provide stability for renters by preventing large rent increases, but not every city or state allows rent control; some have laws against it. In areas with rent control, your landlord can increase your rent up to a maximum percentage or amount that is dictated by the rent control laws. In some states, the annual rent increase allowance takes inflation into account, so your landlord can raise rent by the base percentage rate and add the CPI percentage on top.