New Data: Nearly Half of Renters Don't Negotiate Their Lease, Leaving Money on the Table

Most renters assume the price, terms, and perks of an apartment are set in stone; however, that’s far from true. Negotiating can help you get rent reductions, free parking, waived fees, flexible lease lengths, and more. Yet, nearly half of renters never attempt to negotiate, potentially leaving thousands of dollars and valuable concessions on the table.

To better understand how renters approach the leasing process, Apartments.com surveyed renters aged 18+ nationwide to learn whether they’ve negotiated, what they’re willing to spend on rent, and sacrifices they’ll make to land a dream apartment. Learn more in the key takeaways below and dive deeper into what these results mean for renters.

Key Takeaways

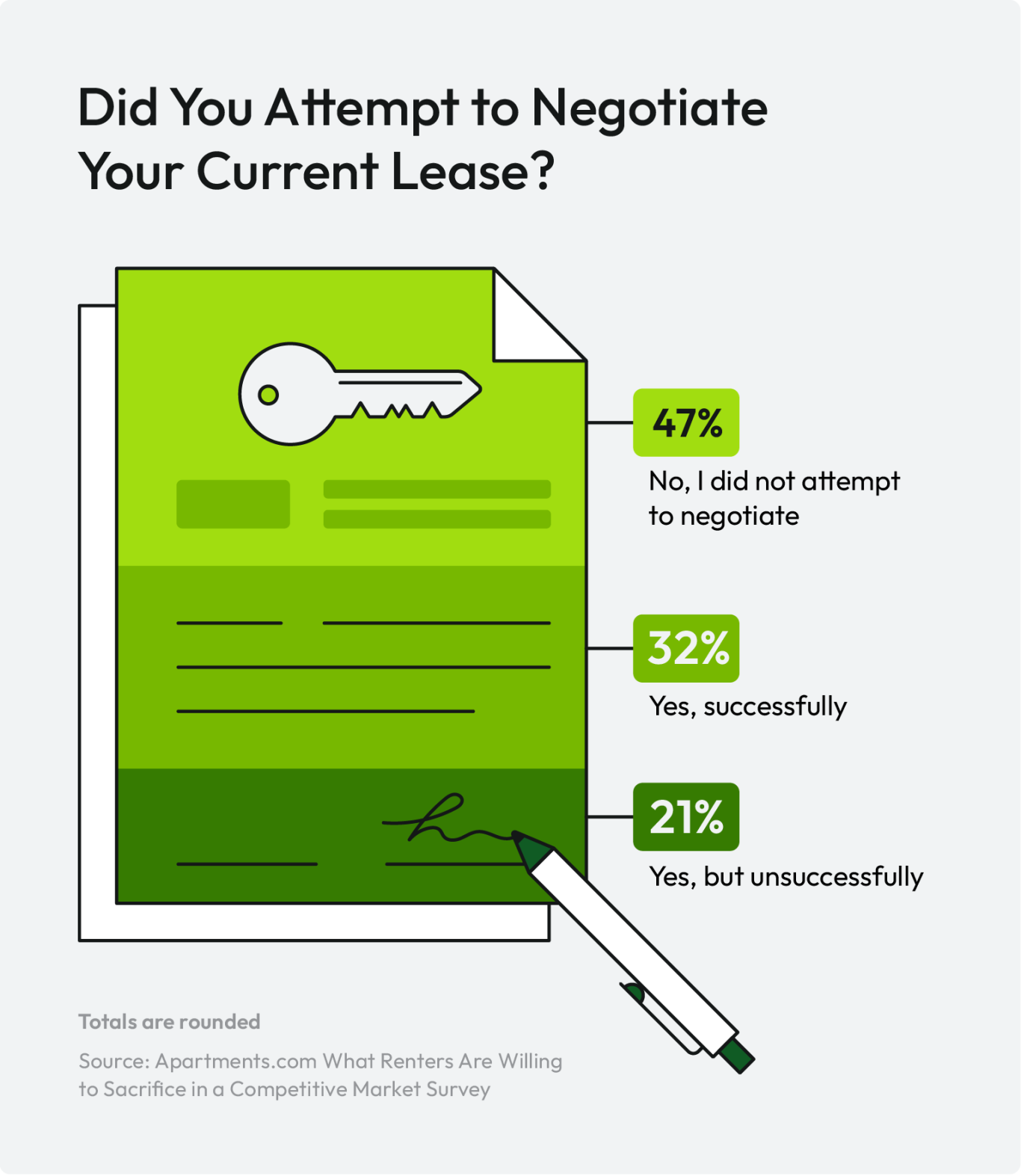

- 47 percent of renters don’t negotiate their lease, but of those who do, more are successful (32 percent) than not (21 percent).

- 35 percent of renters aged 18-29 successfully negotiated, making them the most successful age range.

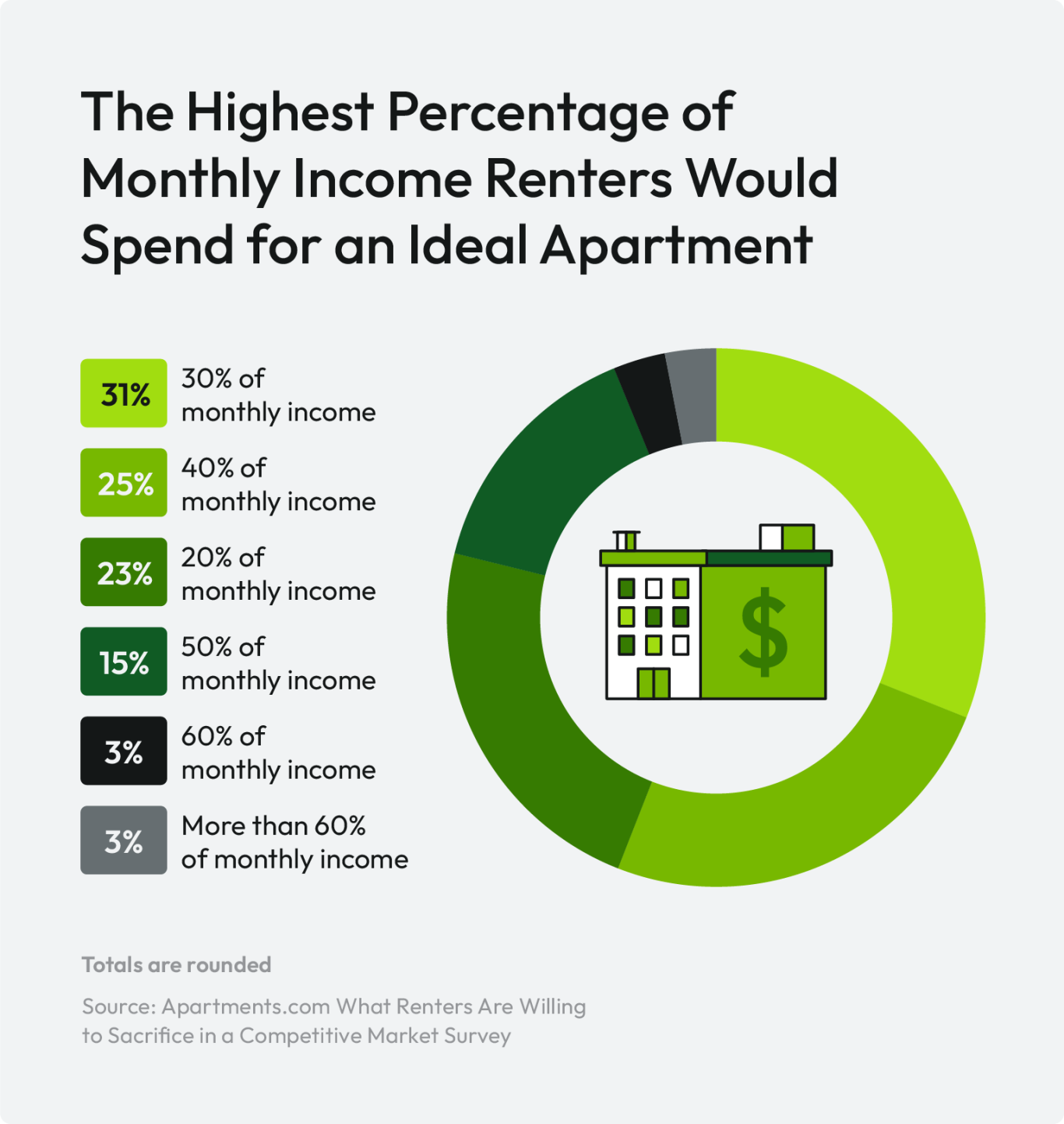

- Almost half of renters are willing to spend more than the recommended 30 percent of their monthly income on rent for an ideal apartment.

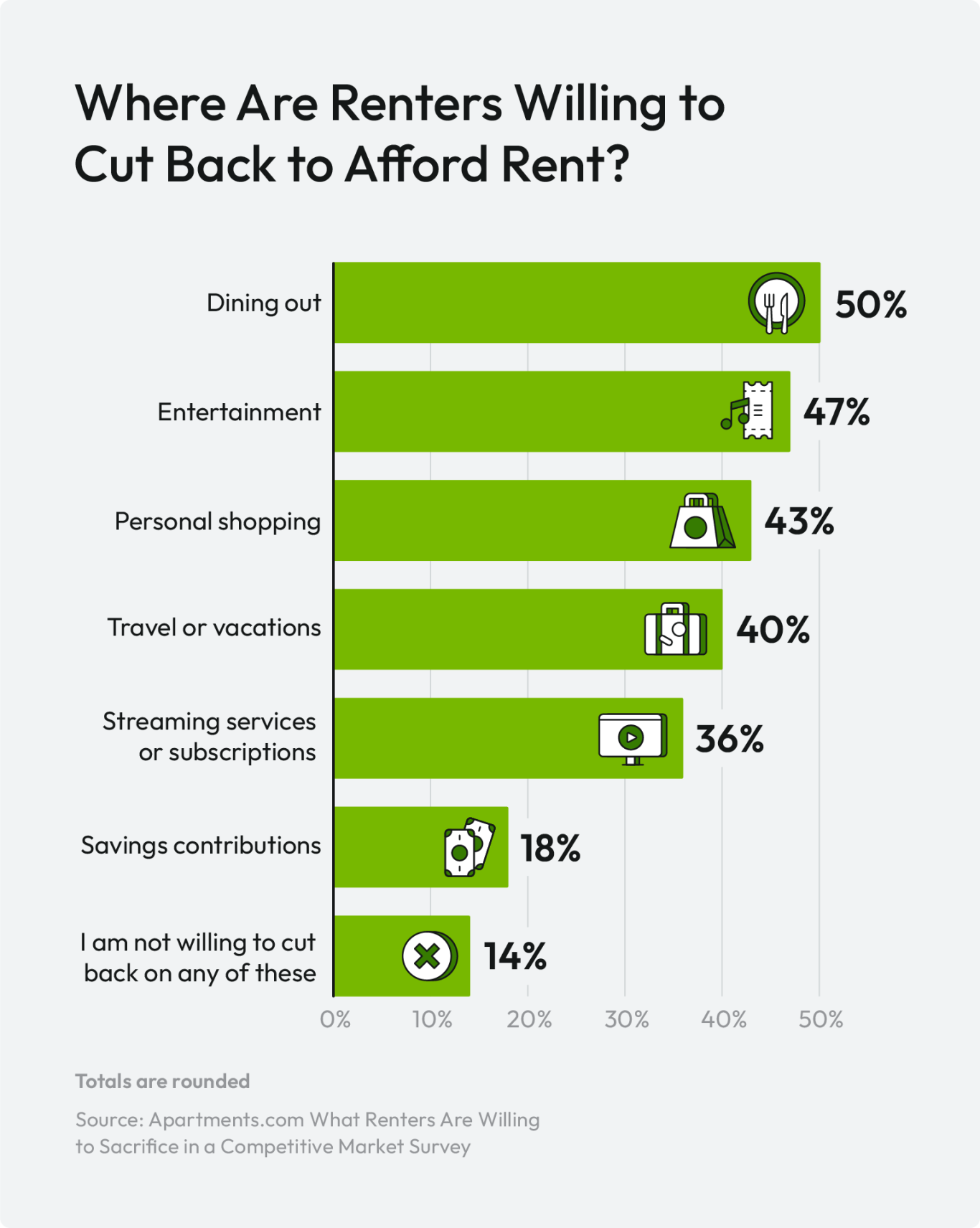

- Renters are willing to cut back on dining out (50 percent) and entertainment (47 percent) to afford rent in competitive markets. Additionally, almost a quarter of 18-29 renters are willing to cut back on retirement savings.

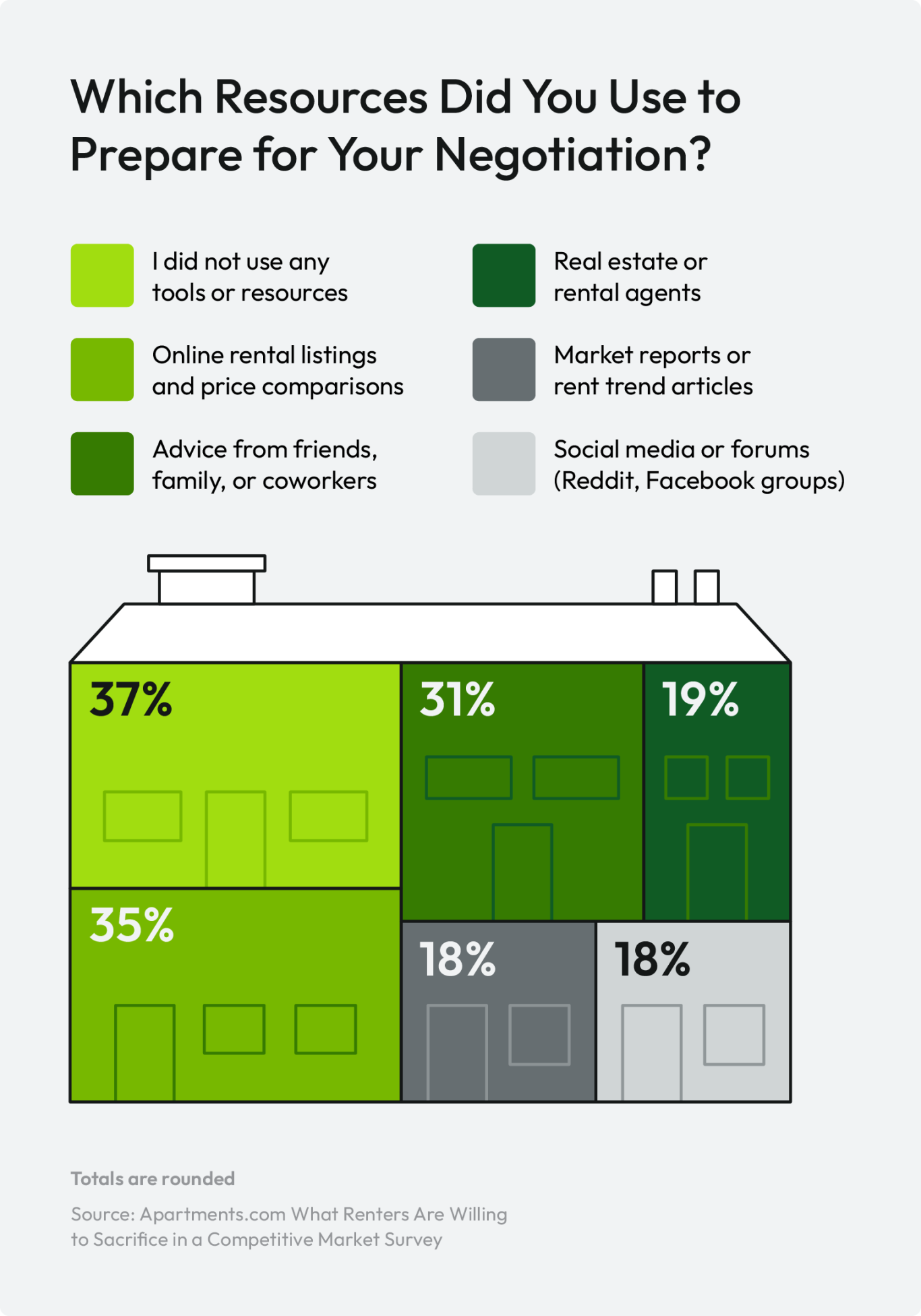

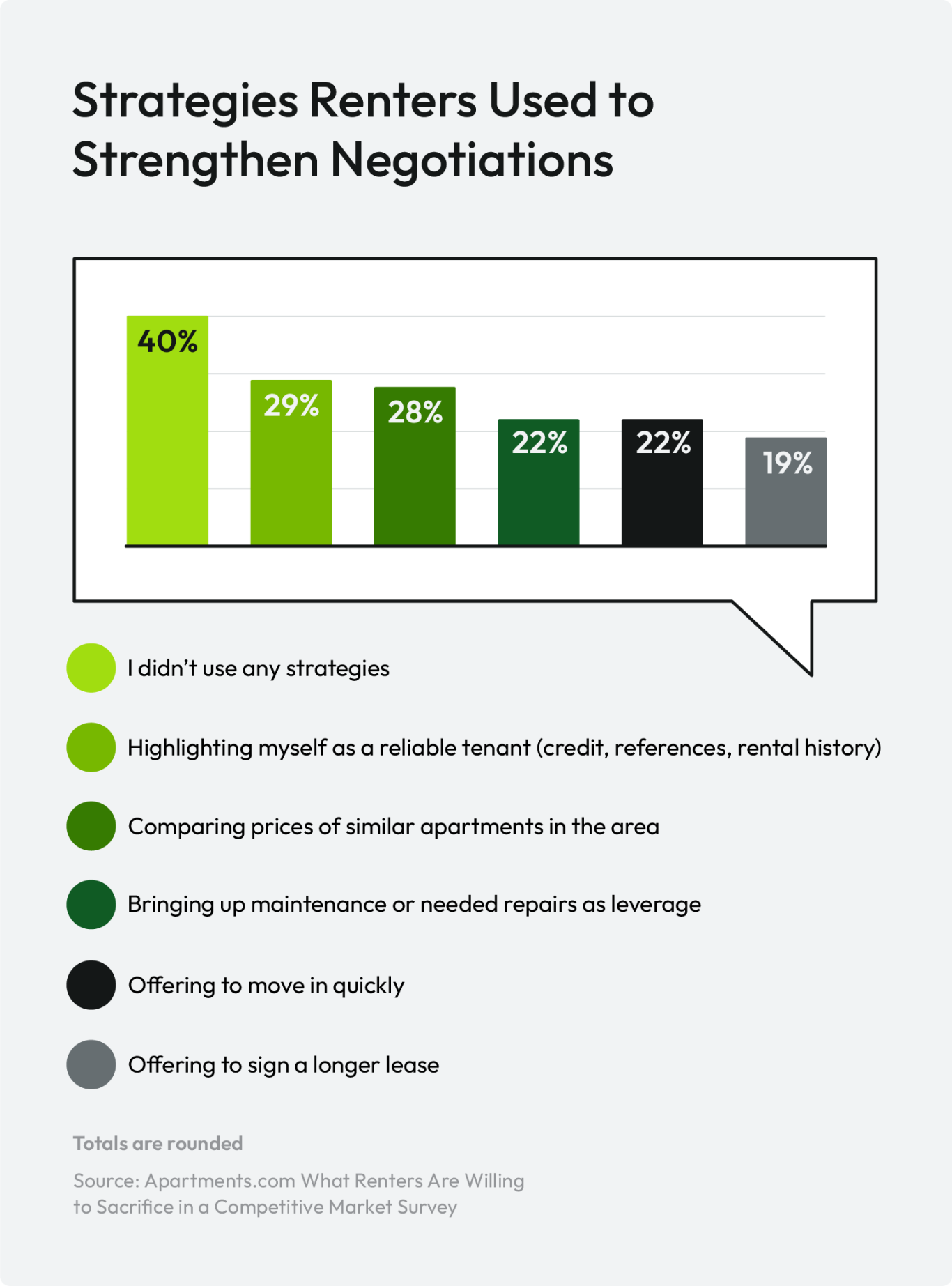

- 40 percent of all renters who attempted to negotiate did not use any strategies, despite the resources available.

Most Renters Don’t Negotiate, But Many Find Success When They Do

Despite the high stakes involved in finding an affordable and desirable living situation, most renters take the terms they're first offered — no questions asked. Our survey found that 47 percent of renters did not attempt to negotiate their current lease, even though doing so could lead to significant savings or perks.

Among those who did negotiate, the odds were in their favor, with 32 percent of renters successfully negotiating their current leases compared to 21 percent who attempted it without success. In other words, renters who make the effort to negotiate are more likely than not to receive discounts and perks.

Interestingly, Gen Z renters are more likely to negotiate, with 35 percent reporting that they have successfully negotiated. Meanwhile, renters aged 60+ were the least likely to negotiate, with 62 percent making no attempt. This data shows that younger tenants are more comfortable advocating for themselves and know how to negotiate rent skillfully compared to older generations.

Don’t Be Shy: Renters Who Negotiate Can Win Concessions

Beyond lowering your rent, negotiating your lease is key to accessing valuable concessions that can immediately lower your expenses and cost of living.

According to our rent concessions survey, 36 percent of renters say a free first month of rent is the most powerful incentive to sign a lease. Additionally, 67 percent of renters say that a lease concession would moderately or significantly sway their choice between similarly priced apartments.

Going into a lease negotiation conversation prepared with popular concessions to fill vacancies proves you’re prioritizing your and your landlord's best interests. Whether you ask for a waived application fee, free parking, or a free first month of rent, the financial reward for stepping out of your comfort zone is substantial. Even lowering your payment by $100 per month translates to $1,200 in annual savings.

By recognizing the availability of concessions and asking confidently, you align yourself with the portion of renters who ask for more and get it rather than settling.

How Much Is Too Much? 46% of Renters Are Willing to Break the 30% Rule for Their Ideal Apartment

Renters are typically advised not to spend more than 30 percent of their monthly income on rent. However, our survey found that 46 percent of today's renters are willing to spend more than the recommended amount of their income on rent to secure their ideal apartment.

This offers a telling sign of the competitive and expensive nature of the current rental market, with renters prioritizing location, safety, and amenities over traditional budgeting guidelines.

With 1 in 4 renters saying they’d spend 40 percent of their monthly income on rent, and 15 percent saying they’d dedicate half of their monthly paycheck to rent, it’s clear that affordability becomes less of a priority against availability and desirability — especially in high-demand areas.

Younger renters are particularly pushing the boundaries of their monthly budget, with 1 in 5 renters aged 18-29 willing to spend half of their paycheck on rent. This likely means that younger generations are cutting spending elsewhere to afford higher rents and the additional expenses that come with them.

The Social Cost of High Rent: Dining Out and Entertainment Are the First Budget Cuts for Half of Renters

The cost of rent is measured in dollars and missed opportunities, especially when you spend a higher portion of your income on rent. According to our survey, common areas where renters are cutting back to afford rent are eating out (50 percent) and entertainment (47 percent).

Renters often sacrifice nights out, concerts, and other social activities, which have costs in other ways — particularly mental well-being and socialization. It’s especially ironic when these cuts are made to live in favorable areas, such as the best rental markets, which are known for vibrant nightlife, exceptional restaurants, and exciting entertainment scenes; however, renters are unable to fully enjoy them.

Beyond these social costs, renters are making sacrifices in other areas, with 43 percent cutting back on personal shopping and 40 percent reducing travel or vacation spending.

These trade-offs become especially concerning among younger renters, with nearly 1 in 4 (22 percent) of those aged 18-29 willing to reduce or pause contributions to savings, such as retirement or emergency funds, to afford rent. This short-term delay may help them immediately stay in their preferred location, but it also sets the stage for reduced financial security in the long term with extensive delays.

Your Secret Weapon: Renters Who Use Online Listings and Price Comparisons Gain a Negotiation Edge

Information is power, especially when it comes to negotiating rent, and renters who do their homework have a clear advantage. According to our survey, the two most popular negotiation strategies are highlighting yourself as a reliable tenant (29 percent) and comparing prices of similar apartments in the area (28 percent). In both cases, renters who show proof during the negotiation stage are more likely to succeed.

Before negotiations, nearly 1 in 3 (32 percent) used online rental listings and price comparisons to prepare, making this a top resource for informed renters. Another 31 percent sought advice from family, friends, or coworkers. This proves that community is still a valuable resource.

Despite all of the tools and data available, 40 percent of renters who attempted to negotiate used no strategies at all. This is a missed opportunity in a market where preparation can make all the difference. If you’re planning to rent or renew, the research phase is essential.

Find Rentals in Your Price Range and Desired Location with Apartments.com

Don’t leave money on the table. Step away from the myth that lease terms are non-negotiable and secure a better deal for your living situation by using our data, which proves that negotiations offer a financial advantage. Using a cost of living calculator will help you understand what you can afford and how much you need to make to live in different cities.

No matter which stage of the rental process you’re in — searching, renewing, researching, etc. — Apartments.com is here to help you along the way. Explore rental market trends to learn more about average costs in your area and the average rent in the U.S.

Methodology

The survey of 1,002 adults ages 18 and over was conducted via SurveyMonkey Audience for Apartments.com on October 15, 2025. Data is unweighted, and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

Do Renters Negotiate Lease Terms FAQs

How do I negotiate with my landlord?

Negotiating with your landlord starts with confidence and preparation. Enter the conversation with facts, not just feelings. Follow these steps to negotiate with your landlord:

- Research current rental prices in your area.

- Identify comparable listings and note any concessions or perks being offered nearby.

- Highlight your reliability as a tenant with proof of on-time payments, good communication, and taking care of the property.

Begin the negotiation conversation early, ideally before the renewal time, and be respectful yet firm in your requests. Even if your landlord can’t lower the rent, they may offer alternative benefits, such as free parking, flexible move-in dates, or waived fees.

What are some commonly negotiated lease terms?

Beyond negotiating the cost of monthly rent, many tenants commonly negotiate:

- Lease length

- Concessions (i.e., free first month's rent, free parking, reduced pet fees, utility coverage, etc.)

- Unit upgrades (i.e., new appliances, repainting, added amenities)

When negotiating, the key is to know what’s negotiable, what matters most to you, and what’s realistic based on local demand.

Why should I negotiate my lease?

Negotiating your lease can save you money, improve your living situation, and give you more control over your rental terms. In high-demand areas, negotiation also helps you ensure you’re paying a fair market rate rather than accepting the first offer at face value.

Initiating negotiations is especially important now, as many renters face tighter budgets and RTO mandates, which are pushing housing demand closer to urban centers again. By negotiating, you can offset some of these rising costs or gain flexibility in lease length and timing. Negotiating your lease allows you to take an active role in shaping your living experience — beyond just saving money.